- EUR/USD has managed to stabilize after falling, without any clear driver.

- Gloom from the ECB, rising eurozone coronavirus cases, and US election uncertainty may weigh heavily.

- Thursday’s four-hour chart is painting a bearish picture.

There is always a countertrend within every trend – and that is probably behind the bounce in EUR/USD, which has no other justification. The world’s most popular currency pair is taking a breather, but the factors that hit it on Wednesday will likely resume, probably driven by the European Central Bank.

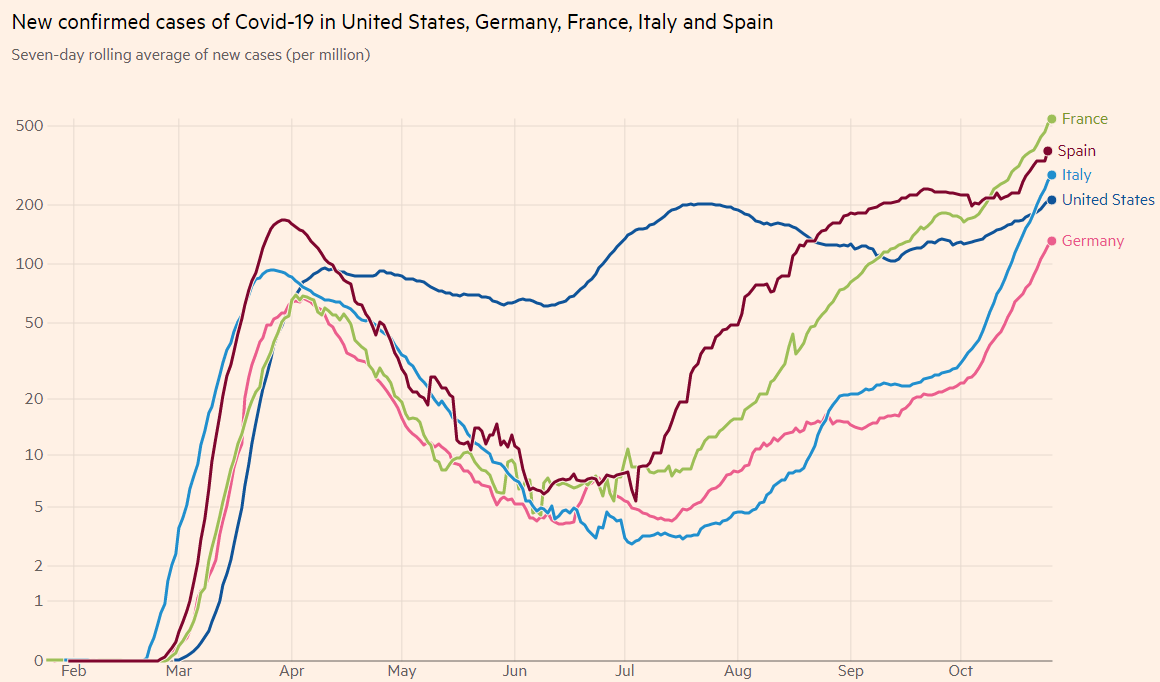

Economists expected the ECB to leave policy unchanged, but events are unfolding rapidly. Both Germany and France declared month-long lockdowns in all of their territories in response to the surge in coronavirus cases. The near-parallel announcements in Berlin and Paris weighed on the euro – and they may push the central bank to act as well.

Cases are surging in the old continent:

Source: FT

Christine Lagarde, President of the European Central Bank, is unlikely to cut interest rates – as they are already at -0.50%. However, the bank could expand the Pandemic Emergency Purchase Program (PEPP) and announce it is accelerating the pace of bond-buying.

She may also opt to lay the groundwork for more action in December when the ECB publishes new forecasts. In any case, the worsening economic outlook will likely be reflected in Thursday’s decision and could weigh on the euro.

See ECB Preview: Three charts show why Lagarde could send EUR/USD tumbling

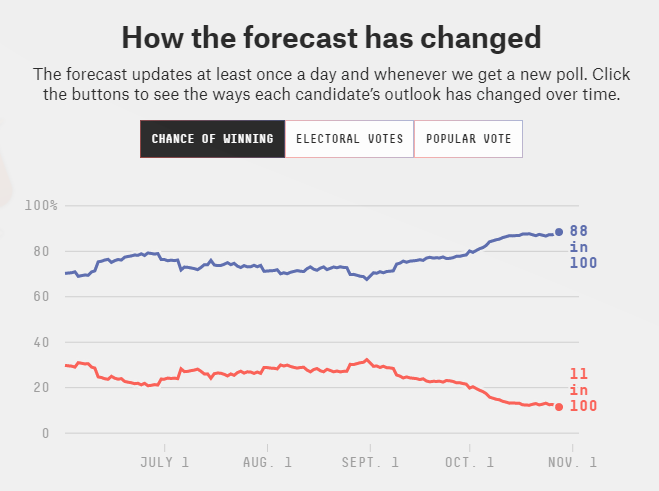

The US elections also carry a dose of uncertainty. A long list of opinion polls published on Wednesday continued showing Democrat Joe Biden leading over President Donald Trump, but the races are close in critical states such as Florida – the perennial swing state – and North Carolina, where a critical Senate race is tight.

Markets prefer a landslide victory for Democrats, that would enable them to pass a massive stimulus package, and seem to shrug off concerns about market-unfriendly policies.

More: How three US election outcomes (and a contested result) could rock the dollar

A dose of stability may come from the fact that over 75 million Americans have already voted – 55% of the total 2016 vote count – and that Biden’s chances are solid. However, the memory of 2016 remains prevalent. Uncertainty drives traders into the safety of the US dollar, and could also push EUR/USD down.

Source: FiveThirtyEight

The ECB decision and the upcoming US elections somewhat overshadow the first release of US Gross Domestic Product for the third quarter.

The all-important publication is set to show a sharp bounce – over 30% annualized growth – after the collapse in the third quarter. While economists will likely pore into the details, investors are set to focus on the political implications.

See: US Third Quarter GDP Preview: Must what goes down, come up?

Overall, the current stability seems like a temporary pause.

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart and is trading below the 50, 100, and 200 Simple Moving Averages. The Relative Strength Index is nearing 30, thus close to oversold conditions, but not there yet.

Support awaits at 1.1715, which is Wednesday’s low point. It is followed by 1.1685, which is a double-bottom touched in October. The next line to watch is 1.1625.

Resistance is at 1.1785, which provided support last week. It is followed by 1.1840, 1.1865, and 1.1880 – all high points on the way down.