- The pair comes up from the mid-1.1600s.

- Italian politics behind the strong bounce off 2018 lows.

- US markets closed. Italy faces the probability of new elections.

After bottoming out in the 1.1650 area, or fresh YTD lows, EUR/USD has regained attention and is now advancing almost a cent to fresh tops in the 1.1730 region.

EUR/USD focused on Italy

The sharp rebound in the demand for the single currency has been boosted after news agency Reuters said the Italian President S.Mattarella has rejected the euro-sceptic P.Savona as finance minister, while G.Conte has stepped down as PM according to Italian newspaper La Stampa

Savona’s rejection has once again shaken the Italian political ground, prompting leaders from the anti-establishment 5-Star Movement and the far right Lega Norte to call for Mattarella’s impeachment and another elections, likely at some point in September/October.

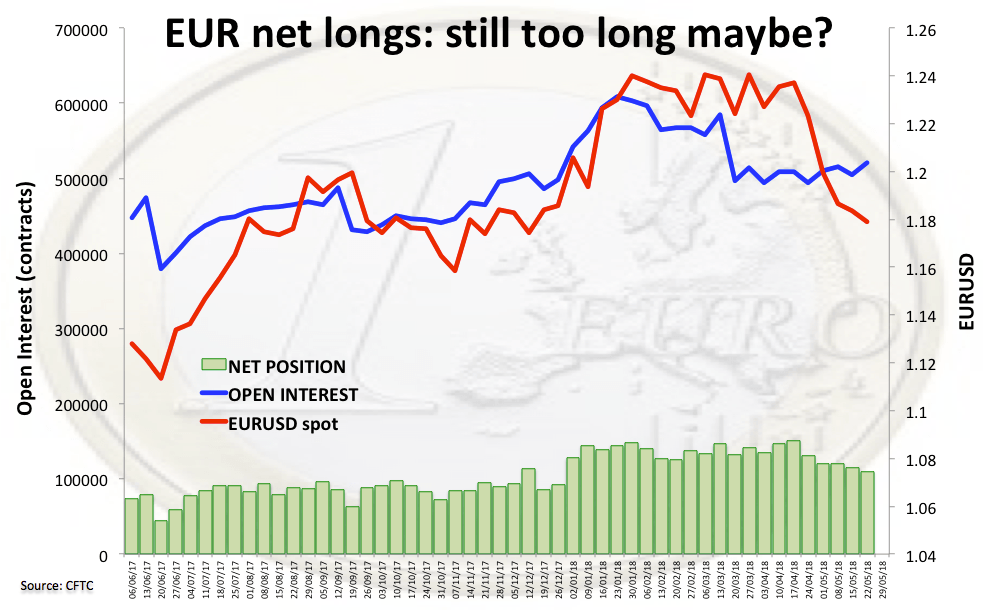

In the meantime, and in spite of the ongoing rebound, EUR remains under pressure amidst a dovish ECB (as opposed to the Fed’s tightening cycle), the apparent slowdown in the economy of the region and extreme positioning.

Regarding the latter, EUR speculative net longs retreated to levels last seen in late December 2017 during the week ended on May 22 according to the latest CFTC report. EUR longs still remain in high levels, allowing for further decline in the next weeks as investors are expected to keep unwinding their positions.

In the data space, US markets will be closed due to the Memorial Day, while Italian Producer Prices and French auctions are only expected in Euroland.

EUR/USD levels to watch

At the moment, the pair is gaining 0.61% at 1.1721 facing the next hurdle at 1.1780 (10-day sma) seconded by 1.1829 (high May 22) and finally 1.1857 (21-day sma). On the flip side, a break below 1.1646 (2018 low May 25) would target 1.1600 (psychological level) en route to1.1553 (monthly low Nov.7).