- EUR/USD clinches daily tops near 1.1160 on German CPI.

- US Core PCE rose 0.2% MoM in June.

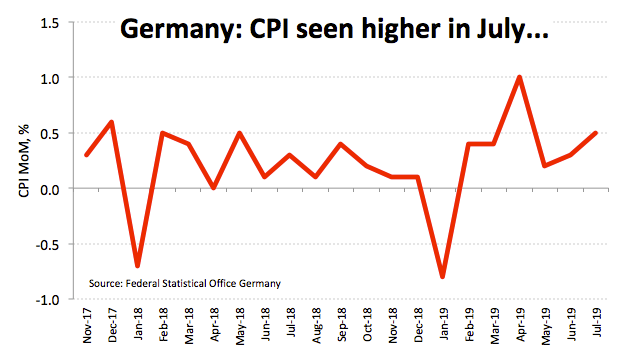

- German advanced CPI surprised to the upside at 0.5% MoM in July.

EUR/USD has turned positive for the day and recorded weekly highs near 1.1160 in the wake of the release of German flash CPI figures.

EUR/USD trims gains post-US PCE

Spot is trading in fresh 3-day highs in the mid-1.1100s after US inflation figures tracked by the Core PCE rose at a monthly 0.2% and 1.6% from a year earlier. Additional US data saw Personal Income and Personal Spending expanding at a monthly 0.4% and 0.3%, respectively.

Earlier in the day, EUR has managed to accelerate the correction higher after advanced German inflation figures gauged by the CPI are expected to rise 0.5% MoM and 1.7% on a year to July, surpassing initial estimates.

In the meantime, spot is expected to keep the familiar range at least until the FOMC meeting tomorrow, where the Fed is forecasted to reduce its interest rate by 25 bps (insurance cut).

What to look for around EUR

The single currency is expected to remain under scrutiny in the next weeks amidst ECB’s preparations for a fresh wave of monetary stimulus, including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system. The ECB has already changed its forward guidance and it now expects rates to remain at ‘present or lower levels’ until at least mid-2020. The unremitting deterioration of the economic outlook in the region and the lack of traction in inflation are seen limiting any occasional bullish attempts in EUR for the time being and also give extra sustain to the dovish stance in the ECB.

EUR/USD levels to watch

At the moment, the pair is gaining 0.06% at 1.1151 and a break above 1.1233 (55-day SMA) would target 1.1286 (high Jul.11) en route to 1.1304 (200-day SMA). On the downside, immediate support lines up at 1.1101 (2019 low Jul.25) seconded by 1.1021 (high May 8 2017) and finally 1.0839 (monthly low May 11 2017).