- EUR/USD prints heaviest daily losses in April, recently offered near intraday low.

- Risk-off mood, US dollar bounce back the consolidation.

EUR/USD refreshes intraday low to 1.1951, down 0.33% on a day by the press time of early Monday. In doing so, the currency major pair refrains from respecting the options market’s bullish bias.

One-month risk reversals of EUR/USD, a gauge of calls to puts, rose for the four consecutive weeks by the end of last Friday.

Risk reversals flashed the +0.025 level, favoring EUR/USD bulls, according to data provided by Reuters. The positive reading indicates call options are drawing higher premium (option price) than put or bearish bets.

While searching for catalysts, the risk-off mood could be traced for the pair’s latest losses. Among the risk-negative factors, challenges to US President Joe Biden’s $2.25 trillion infrastructure spending and the coronavirus (COVID-19) worries in Europe and Asia back the downbeat mood.

Against this backdrop, S&P 500 Futures drop 0.25% while the US 10-year Treasury yield drops 1.2 basis points to 1.562% by the press time.

Given the lack of major data/events, EUR/USD may respect the US dollar’s bounce. Moving on, traders should keep their eyes on the risk catalysts for fresh impulse.

Double-top confirmation backs intraday sellers…

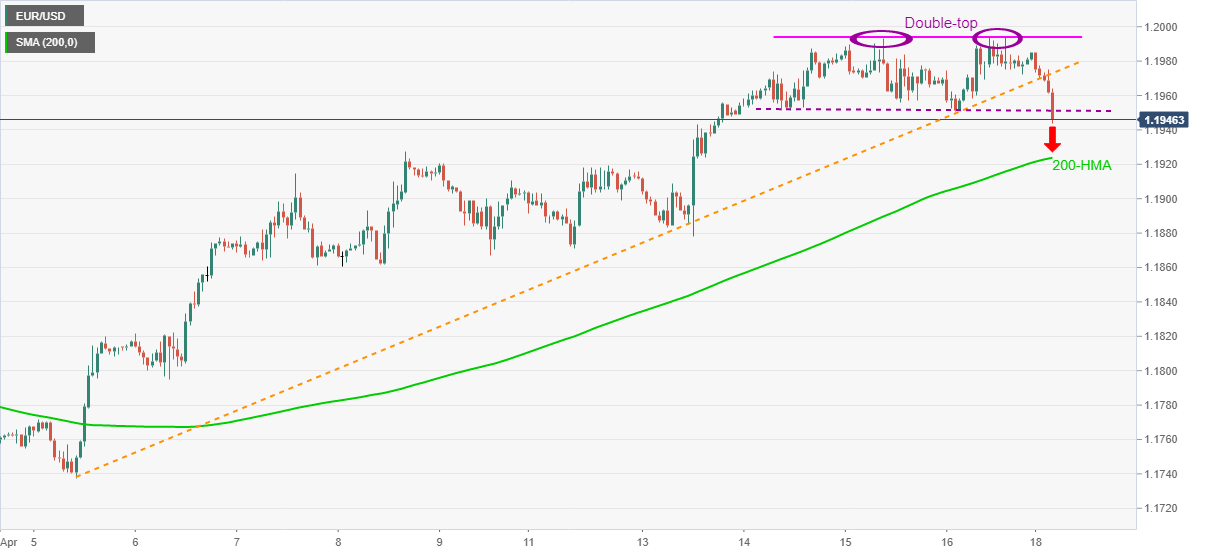

Technically, the pair confirms “double-top” bearish chart formation on the hourly play and directs EUR/USD sellers toward the 1.1900 threshold.

Read: EUR/USD Price Analysis: Teases double-top bearish formation below 1.2000