- EUR/USD has been extending its gains as the dollar declines with yields amid vaccine hopes.

- Concerns about Germany’s covid situation and end-of-month flows may limit gains.

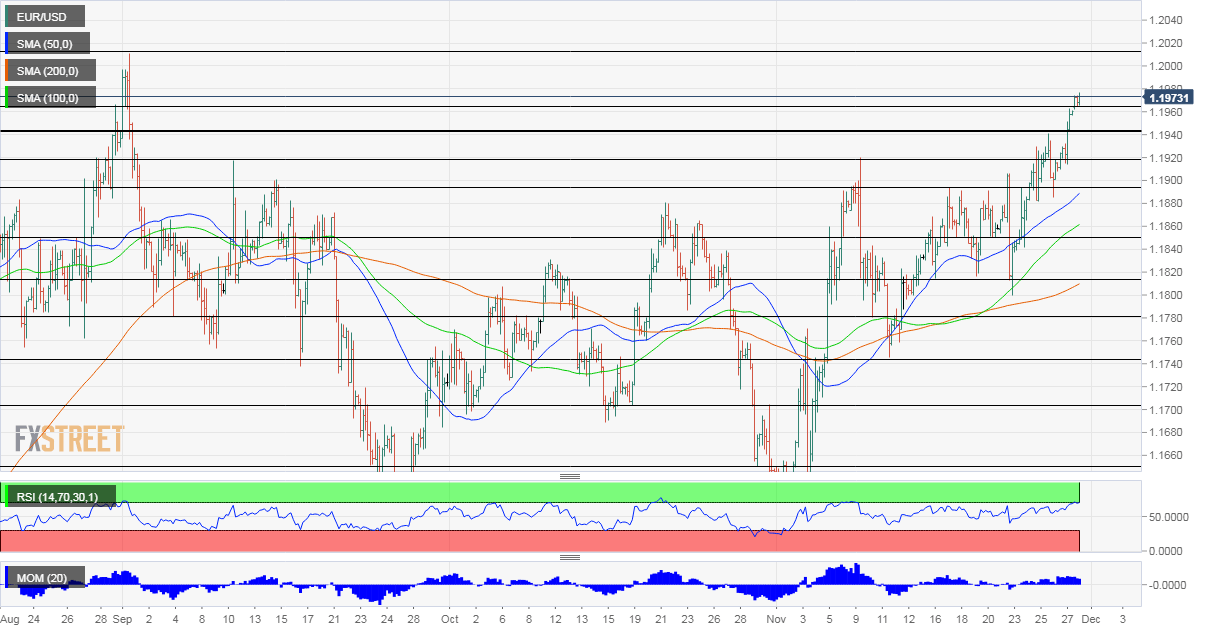

- Monday’s four-hour chart is showing the pair is heading into overbought conditions.

Light at the end of the tunnel – and also 1.20 is within reach – but a downtrend correction cannot be ruled out as EUR/USD hits a three-month high.

The good news pushing the euro higher comes from the vaccine front. British regulators could be the first out the door in approving the Pfizer/BioNTech COVID-19 vaccine. As BioNTech is a German firm, approval in the EU will likely follow shortly. Moderna’s inoculation will likely follow. Even if European and American authorities wait longer, the first immunization program to receive the green light in the West is set to boost markets.

The US dollar has also been on the back foot as investors take profits on stocks and buy US bonds. The drop in yields is making the greenback less attractive.

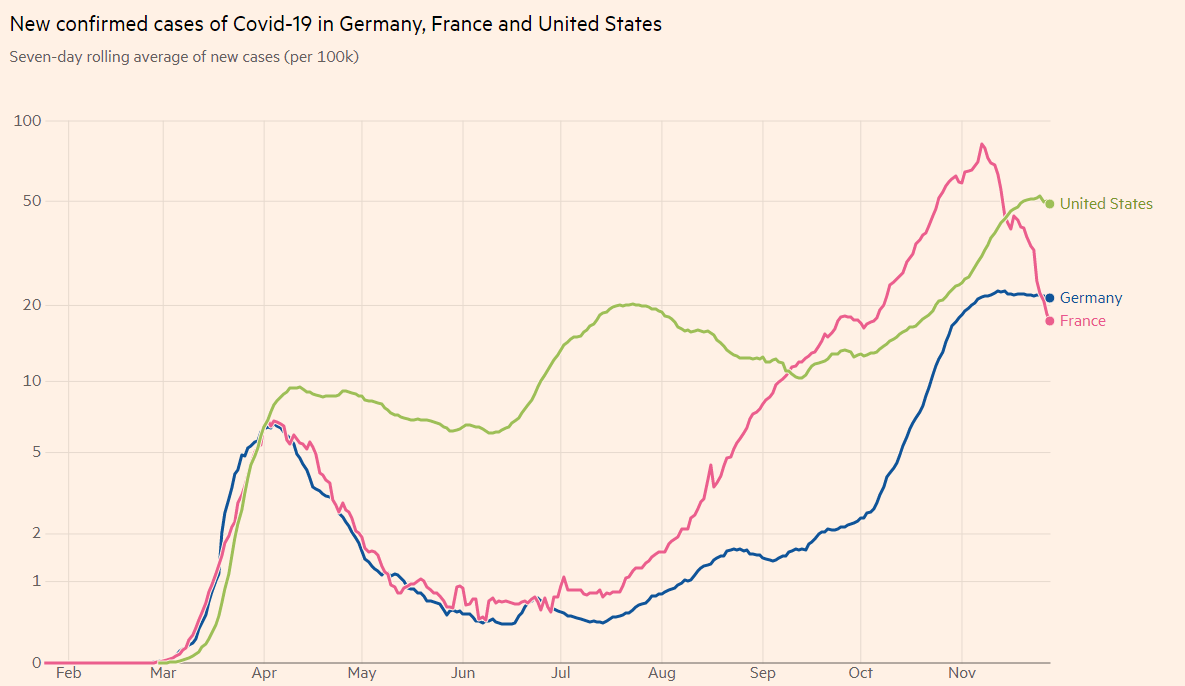

On the other hand, coronavirus is still rampant in the US – where hospitalizations have hit a new high above 93,000 – and Germany. The drop in US infections is likely temporary, a result of reporting issues around the Thanksgiving holiday. Contrary to Spain and France, the old continent’s largest economy is struggling to contain the disease and has extended its “lockdown light. ”

Source: FT

Germany’s economy minister said that that the covid numbers are still “much too high” in most regions. Such comments may limit any euro gains.

The common currency may also struggle with updated inflation figures. Spain and Germany are set to report preliminary Consumer Price Index statistics for November and they will likely serve as a reminder of economic weakness. Christine Lagarde, President of the European Central Bank, is set to speak later and repeat her message of adding stimulus in the upcoming meeting.

The case for a “fakeout” – a quick move above 1.20 before a sharp correction lower – also comes from end-of-month flows. After EUR/USD advanced from the 1.16 handle early in the month, money managers may balance their portfolios and sell the common currency.

All in all, the trend remains to the upside, but another leg higher could trigger a downfall.

EUR/USD Technical Analysis

Euro/dollar continues trading above the 50, 100 and 200 Simple Moving Averages on the four-hour chart, but the Relative Strength Index is battling the 70 level – pointing to overbought conditions. This development also adds to the case of a downward correction.

Initial resistance awaits at the daily high of 1.1978. Above the round number of 1.20, the critical level to watch is the 2020 peak of 1.2010. Above that hurdle, the world’s most popular currency pair is back to levels last seen in 2018, with 1.2095 as the next target.

Support awaits at 1.1940, a peak seen last week. It is followed by 1.1920, a high point recorded in mid-November, and by 1.1895.