- The pair picks up some pace beyond the 1.1300 handle.

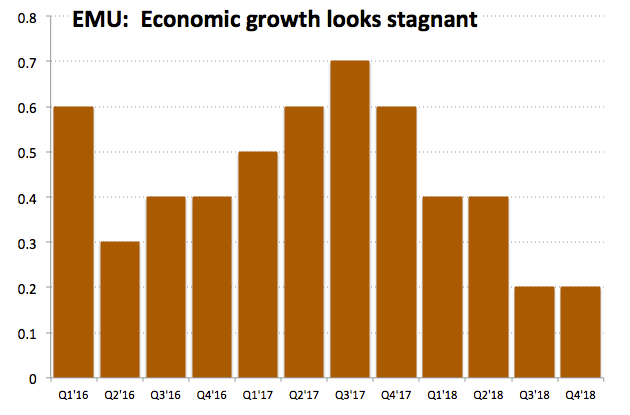

- EMU economy expanded 1.1% YoY during the fourth quarter.

- The ECB is expected to leave rates, forward guidance unchanged.

The shared currency is now gathering some traction and is pushing EUR/USD further north of the 1.1300 handle ahead of the ECB event.

EUR/USD attention remains on ECB

The pair is posting some decent gains following four consecutive sessions with losses, managing to regain some buying interest above the critical barrier at 1.1300 the figure after yesterday’s ‘doji’ candle.

Spot is reverting the recent negative streak and extending the rebound from weekly lows in the 1.1290/85 band recorded on Wednesday amidst some renewed weakness hitting the buck.

EUR paid little-to-none attention to today’s docket in the euro area, where Employment Change rose at an annualized 1.3% in Q4 and the economy in the bloc expanded 1.1% on a yearly basis during the same period, below consensus.

Moving forward, the ECB event is coming up next. Market participants will closely follow both the statement and Dragjhi’s press conference looking for any clues on the potential implementation of another TLTRO.

What to look for around EUR

In line with the broader risk-associated complex, the shared currency continues to look to developments from the US-China trade negotiations for near term direction. Additionally, the ECB is expected to remain in ‘pause mode’ for the foreseeable future amidst the ongoing slowdown in the region. Furthermore, investors have practically priced out any up move in rates this year and they’re even considering the probability of another TLTRO in case the outlook deteriorates further. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among members.

EUR/USD levels to watch

At the moment, the pair is gaining 0.07% at 1.1313 and a breakout of 1.1326 (21-day SMA) would target 1.1381 (55-day SMA) en route to 1.1419 (high Feb.28). On the other hand, the next support aligns at 1.1285 (low Mar.6) followed by 1.1234 (2019 low Feb.15) and finally 1.1216 (2018 low Nov.12).