- EUR/USD extends the rebound beyond the 1.0900 mark on Tuesday.

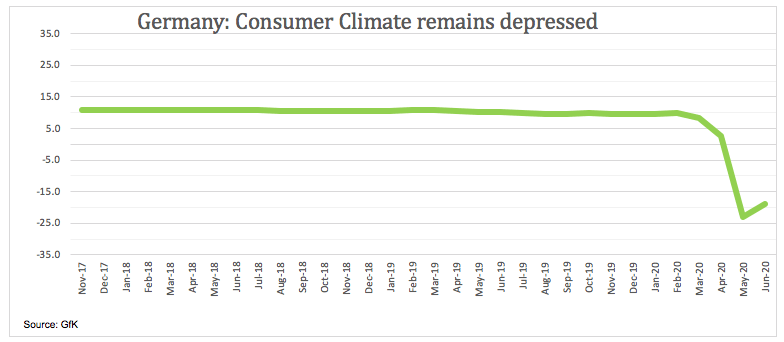

- German GfK’s Consumer Climate came in at -18.9 in June.

- US Consumer Confidence, housing data next of relevance later.

The shared currency regains the smile and pushes EUR/USD back above the 1.0900 mark on turnaround Tuesday.

EUR/USD looks to data, dollar

EUR/USD manages to post some decent gains for the first time after three consecutive pullbacks, regaining at the same time the area above 1.0900 the figure and always on the back of renewed selling pressure in the greenback.

In fact, sellers have put the buck under some pressure as of late despite US-China trade woes remain well on the table and have been lately exacerbated by the China-Hong Kong effervescence.

In the calendar, the German GfK Consumer Climate missed estimates at -18.9 in June, although rebounding from May’s -23.1. Across the Atlantic, the Conference Board’s Consumer Confidence will be in the limelight seconded by housing data and regional gauges by the Dallas Fed and the Chicago Fed.

What to look for around EUR

EUR/USD came under renewed selling interest after failed to surpass the key 1.1000 mark last week. In addition, the sentiment around the greenback improved on the back of the resumption of US-China trade jitters, all putting the pair under extra pressure. The recent better-than-expected results in Germany and the broader euro area along with positive prospects regarding the re-opening of some economies in the bloc appear to keep occasional bearish attempts contained, all helped by the solid position of the euro area’s current account. In the political scenario, the recent German court ruling against purchases of sovereign debt under the ECB’s QE programme threatens to widen the existing cracks within the euro area and could limit any serious recovery in the currency. This view has been also exacerbated after the French-German proposed fund to help economies to recover from the coronavirus fallout met resistance among some Northern-European members.

EUR/USD levels to watch

At the moment, the pair is gaining 0.25% at 1.0922 and a breakout of 1.0999 (weekly high May 20) would target 1.1010 (200-day SMA) en route to 1.1019 (monthly high May 1). On the downside, immediate contention is located at 1.0774 (weekly low May 14) seconded by 1.0727 (monthly low Apr.24) and finally 1.0635 (2020 low Mar.23).