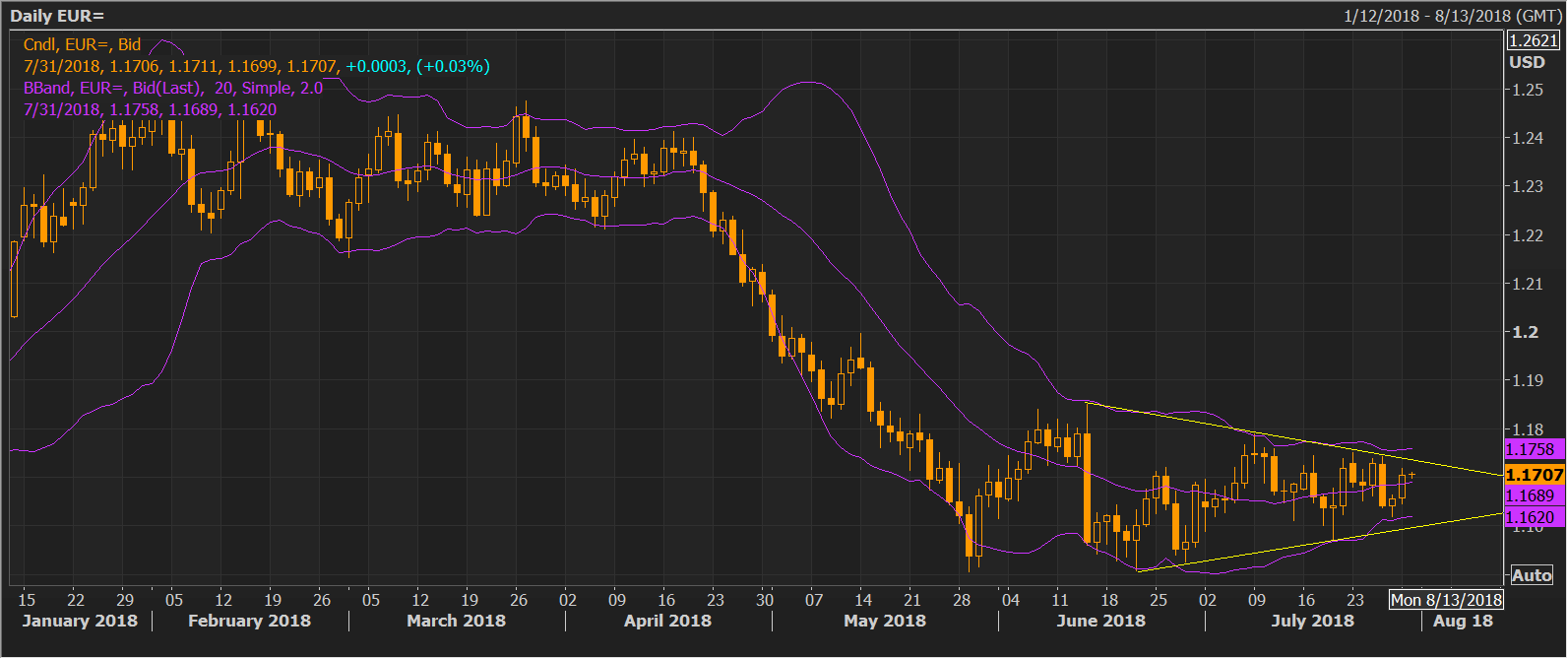

- The EUR/USD volatility as represented by Bollinger bands continues to drop.

- The pennant pattern extends. The pennant resistance is now located at 1.1731 and the base is at 1.1601.

- Inflation readings in the Eurozone and US could yield a much-awaited breakout of the pennant pattern.

The EUR/USD continues to gyrate 1.17 with volatility, as represented by narrowing Bollinger Bands, hovering at 21-month lows.

Focus on inflation differential

The Eurozone preliminary consumer price index (CPI), scheduled for release at 06:00 GMT, is expected to show the cost of living rose 2 percent year-on-year in July. The core CPI is seen rising 1 percent.

Meanwhile, across the pond, the Fed’s preferred measure of inflation – the core personal consumption expenditure (PCE) price index – is seen rising 2 percent.

An above-forecast Eurozone CPI could put a strong bid under the EUR/USD. However, the gains would be sustained only if the core PCE, scheduled at 12:30 GMT, prints below estimates. On the other hand, the EUR/USD could begin the journey toward the pennant support of 1.1601 if the Eurozone CPI misses estimates and the US core PCE strengthens the case of faster Fed rate hikes.

The Eurozone Q2 GDP reading, also due at 09:00 GMT and the US personal spending and income numbers, due at 12:30 GMT, could also influence the pair.

EUR/USD Technical Levels

Resistance: 1.1731 (pennant resistance), 1.1791 (July 6 high), 1.1852 (June 14 high).

Support: 1.1675 (50-day moving average), 1.1620 (lower Bollinger Band as per the daily chart), 1.1508 (June 21 low).