- EUR/USD slightly gains on the day ahead of the key ECB meeting.

- In the past week, market sentiment has been shaken by heightened fears of a slowdown in the economy’s recovery.

- Robert Kaplan’s hawkish remarks also added to the dollar’s strength. Kaplan also called for a reduction in October.

The EUR/USD pair forecast shows mixed sentiment as the market awaits the ECB meeting on the day. In addition, Fed’s recent hawkish comments keep the lid on the gains.

The EUR/USD pair is trading at 1.1824, up 0.10%, at writing.

-Are you looking for automated trading? Check our detailed guide-

With moderate intraday demand above 1.1820, the EUR/USD pair bounces off weekly lows ahead of the European Central Bank’s (ECB) key monetary policy decision on Thursday. However, the listing develops a three-day downtrend simultaneously, as pair traders repeat the lull that persisted before the ECB and favors bullish moves in the regional currency (Euro).

Despite the surge in inflation, it seems the central bank will maintain its ultra-weak policies. Nevertheless, we will certainly discuss tapering. The tone of EUR/USD will be set by what policymakers say. A revision of inflation and growth forecasts is also expected by the ECB.

In the past week, market sentiment has been shaken by heightened fears of a slowdown in the economy’s recovery, including the Fed’s Beige Book, which signaled a slowdown. However, it is important to note that the rapid spread of Delta Covid could turn the economic recovery into a train wreck.

Robert Kaplan’s hawkish remarks also added to the dollar’s strength. Kaplan also called for a reduction in October. Risk-averse sentiment continues to pressure US Treasury bond yields despite negotiated reductions. Several Asian indices, including S&P 500 futures, have lost ground.

We will also be watching the US unemployment data, and President Biden’s much-discussed pandemic plan shortly, in addition to the ECB data.

-If you are interested in forex day trading then have a read of our guide to getting started-

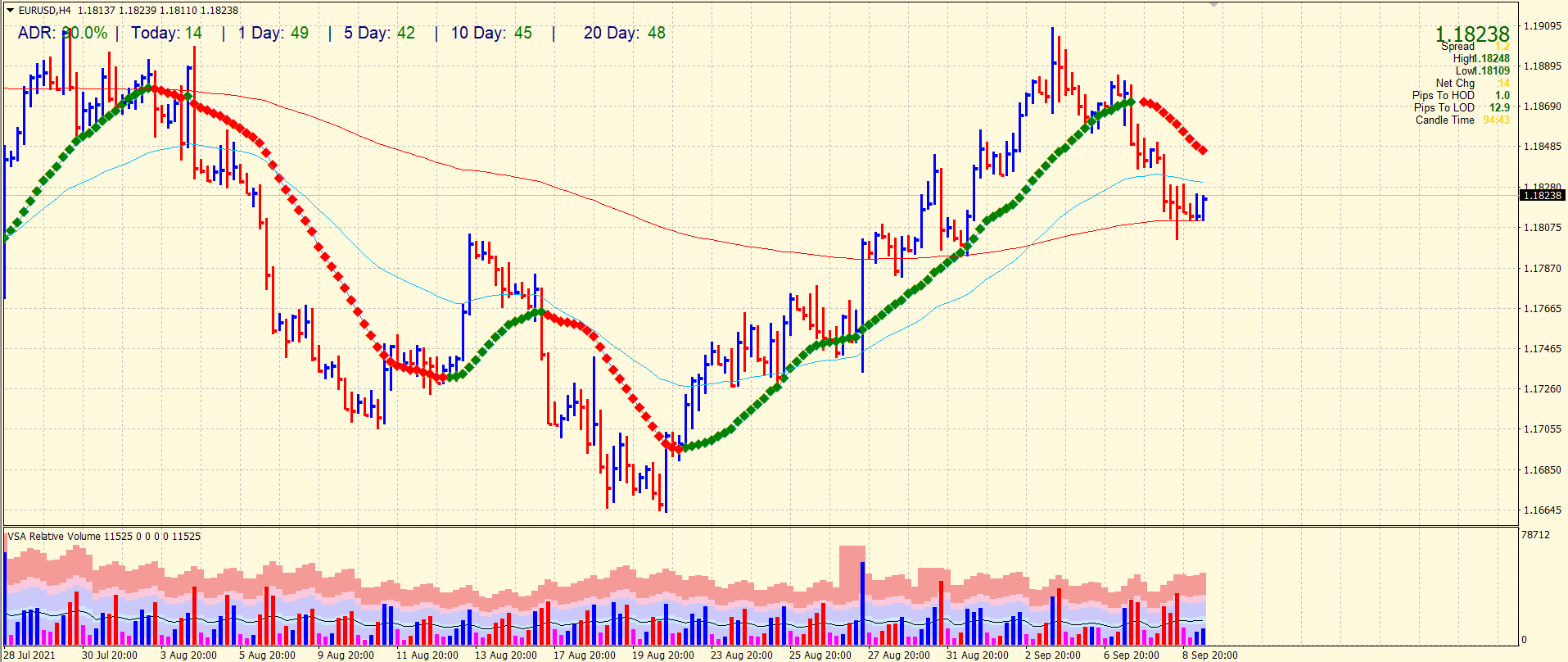

EUR/USD price technical forecast: Bears may break 1.1800

The EUR/USD price finds resort at 200-period SMA on the 4-hour chart. The average daily range is 30% so far which is low. It means the traders are waiting for the ECB meeting decision. Despite a slightly positive tone, the price may find a hurdle at 20-period SMA around 1.1845. Staying below the 20-period SMA will likely keep bears active, aiming for 1.1800 and lower. On the upside, if 1.1845 (20-SMA) is broken, the pair may aim for 1.1910 (double top).

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.