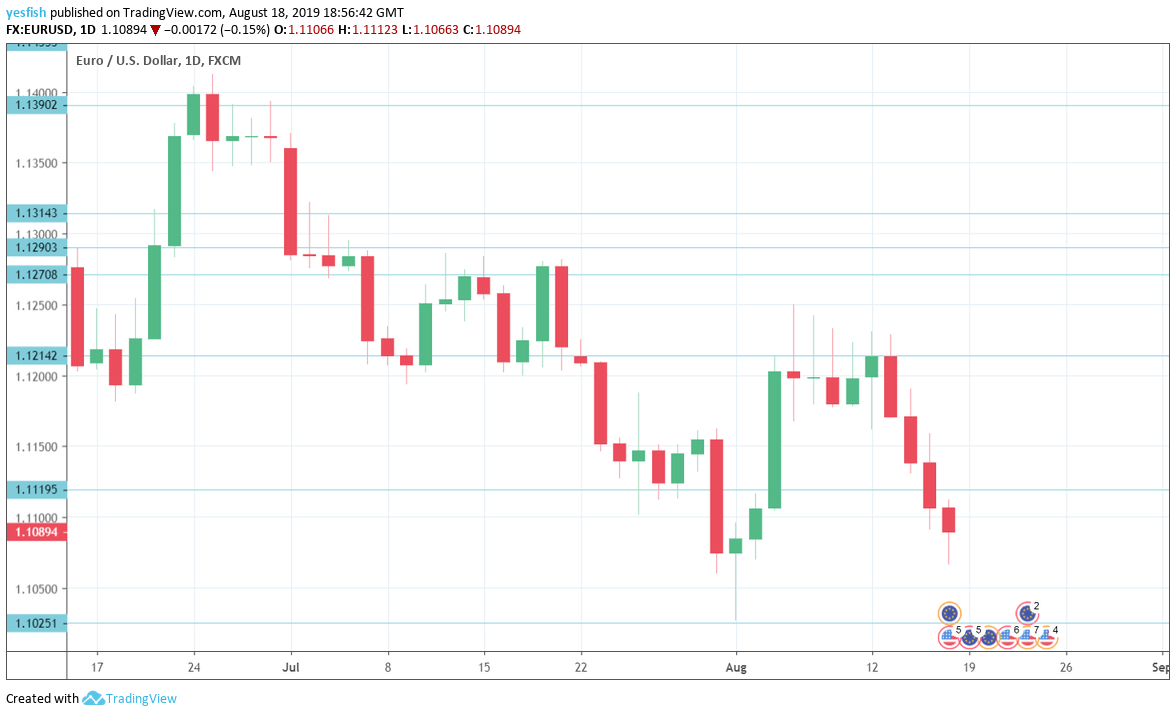

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

In the U.S., there was positive news from consumer inflation and spending numbers. CPI climbed 0.3% in July, matching the forecast. Core CPI remained steady at 0.3%, beating the forecast of 0.2%. Retail sales rose 0.7%, easily beating the estimate of 0.4%. Core retail sales sparkled with a gain of 1.0%, its best showing since March. On the manufacturing front, the Philly Fed Manufacturing Index slowed to 16.8, but still beat the estimate of 10.1.

- Current Account: Monday, 8:00. The eurozone’s current account surplus climbed to EUR 29.7 billion in May, up from 20.9 a month earlier. The upward trend is expected to continue in June, with an estimate of 32.2 billion.

- Eurozone Inflation Data: Monday, 9:00. Final CPI improved to 1.3% in June, edging above the forecast of 1.2%. The estimate for the July release is 1.1%. Final Core CPI climbed to 1.1%, matching the estimate. The index is expected to slow to 0.9% in June.

- PMIs: Thursday, 7:15 for France, 7:30 for Germany, and final euro-zone number at 8:00. French Flash Services PMI came in at 52.5, pointing to weak expansion. The forecast for August is 52.5. The manufacturing PMI came in at 50.0 in July, which separates expansion and contraction. The August estimate stands at 49.5. German manufacturing continues to show contraction. The July reading slipped to 43.1, and no change is expected in the upcoming release. The services PMI continues to show strong expansion and came in at 55.4 in July. The August estimate is 54.1. Eurozone Flash manufacturing PMI dropped to 46.4 in July, and the August forecast stands at 46.3. The services indicator came in at 53.3 in July. The index is projected to drop to 53.0 in August.

- ECB Monetary Policy Meeting Accounts: Thursday, 11:30. The minutes will provide details of the policy meeting earlier in July. As expected, the ECB maintained interest rates. If policymakers are dovish about the economy, the euro could lose ground.

- Consumer Confidence: Thursday, 14:00. Eurozone consumer confidence has been steady, with readings of -7 in five of the past six months. Another reading of -7 is expected in the August release.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1515 was a high point at the end of January. 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1345 is next. 1.1290 has held in resistance since the first week of July.

Close by, 1.1270 was a double-bottom in December 2018.

1.1215 is the next resistance line.

1.1119 (mentioned last week) switched to a resistance role as EUR/USD lost ground

1.1025 was a cap back in May 2017.

1.0950 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I remain bearish on EUR/USD

The eurozone economy continues to limp, and the German locomotive is also struggling. Weak global conditions and the U.S-China trade war have taken a heavy toll on the eurozone and German manufacturing sectors. Further global trade tensions could weigh on the euro.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!