- Policymakers continue to dampen hopes for a Fed pivot.

- The Fed plans to make future rate hikes smaller due to policy lag.

- The Fed intends to raise its policy rate above the 4.6% forecast.

Today’s EUR/USD forecast is slightly bearish. Neel Kashkari, president of the Minneapolis Federal Reserve Bank, said on Wednesday that it is “entirely premature” to consider a shift away from the Fed’s current tightening strategy, even though he seemed to support the idea of changing the size of future rate hikes.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

“I think we are on a good path right now: I think we are united in our commitment to getting inflation back down to 2%,” Kashkari said

Last week, the Fed increased its policy rate by 75 basis points, to a range of 3.75%-4%, to combat inflation at its highest level in 40 years.

Jerome Powell, the chairman of the Federal Reserve, hinted that as central bankers account for policy lags, future rate hikes may occur in smaller chunks. But he also hinted that the policy rate would probably need to rise above the 4.6% forecasted by policymakers just a few months ago. Similarly, Kashkari highlighted that the Fed had not yet finished hiking rates.

“Any talk of pivot is entirely premature,” he said. He said that the economy was a “long, long, long way” from the point where the Fed’s two goals would conflict, forcing a pivot on policy. The goals are stable prices and maximum employment.

EUR/USD key events today

Investors will pay attention to US inflation data. According to a Reuters poll, October’s monthly and yearly core figures will likely decrease to 0.5% and 6.5%, respectively. There will also be an initial jobless claims report that will shed light on the US labour market.

EUR/USD technical forecast: Bear vs bulls at parity

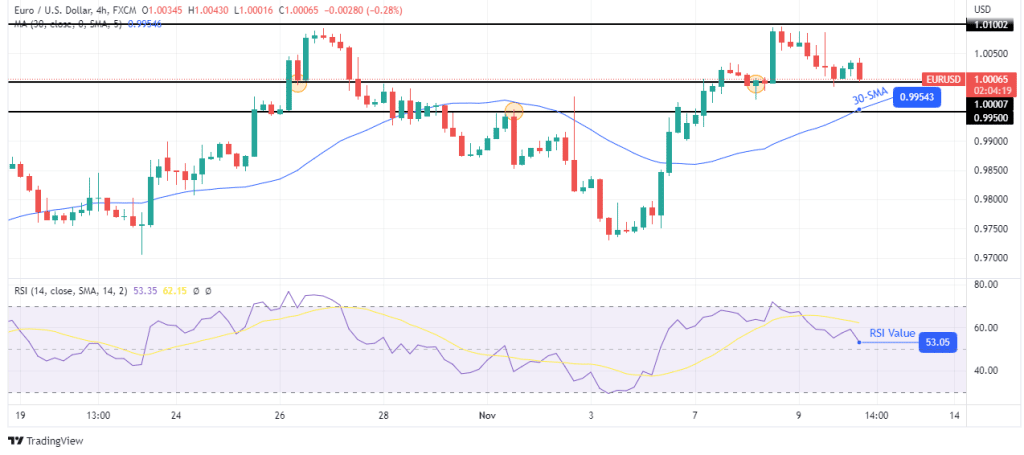

Looking at the 4-hour chart, we see the price trading above the 30-SMA and the RSI above 50, showing a bullish trend. After an initial hesitant break above parity, the price retested and bounced off this level with a strong bullish candle.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, bears have managed to retrace the entire move, pulling the price back to 1.0000. If this level holds as support, bulls will return and look to take out resistance at 1.0100. However, if bears manage a break below parity, the price will probably retest support at 0.99500.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.