- EUR/USD price remains positive, but the bulls remain limited by 1.1750 level.

- Despite the broad dollar weakness, Euro underperforms against the USD.

- Market participants anticipate that the upcoming German IFO data may provide some boost to the Euro.

The EUR/USD price forecast is bullish even though the bulls remain capped by the key 1.1750 level. The pair rebounded early Friday from its highest daily rise in six weeks.

At the time of writing, the EUR/USD pair is at 1.1738, up 0.00% on Friday.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Fundamental analysis: Evergrande and USD to guide the Euro

Despite the previous day’s bullish sentiment, the major currency pair continued to underperform the US dollar. The absence of important dates/events, however, limits any decisive price action in the pair.

Furthermore, China’s Evergrande will be paying coupons, and its latest restructuring must also be justified, which encourages the market. The cautious stance that preceded the release of the data and the Fed’s rethinking of its aggressive plan had tamed the EUR/USD by the time the data was released.

The Fed’s rate hike and cut signals, coupled with China’s aid to Evergrande, offer a glimmer of hope for the Euro buyers.

The 10-year Treasury yield reached an 11-week high of 1.43% after its strongest daily rise since February amid these developments. Further, the S&P 500 futures are up 0.15%, the third consecutive day of gains.

The EUR/USD price hike is likely to be bolstered by the German IFO data for September. Still, US new home sales for August, expected in August, are predicted to exceed expectations by 0.7 million rather than 0.708 million. In addition, several Federal Reserve System (FRS) speakers will be speaking on Friday, including Chairman Jerome Powell, which will trigger some activity in the future. Thus, to conclude a volatile week, risk catalysts are crucial to watch.

EUR/USD price technical forecast: 50-SMA and 1.1750 capping bulls

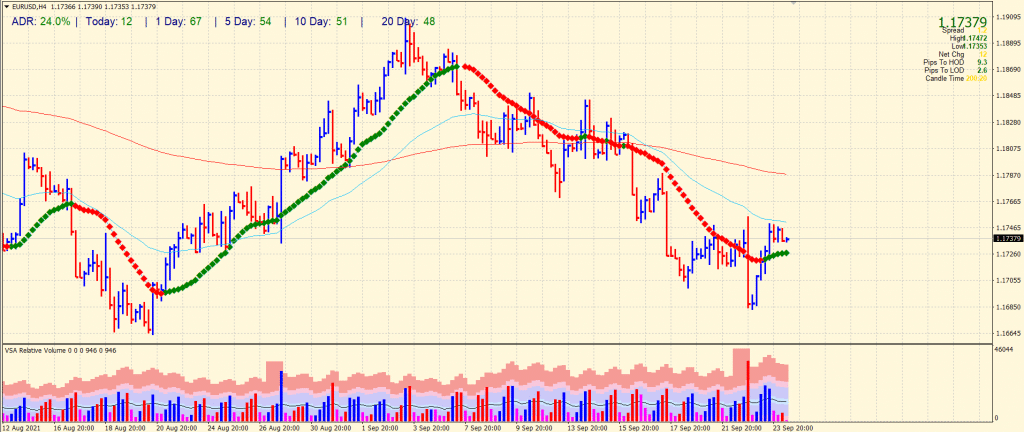

The EUR/USD price remains positive above the 20-period SMA on the 4-hour chart. However, the 50-period SMA and the key level of 1.1750 continue to limit the Euro rally. The pair remains unmoved on Friday as the average daily range is only 24% so far. However, we expect some action as the European session opens.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

If the price manages to capture the 50-period SMA, we may see a bull run towards 1.1800. Never forget, the pair left a double top at 1.1910, and bulls might prepare for a strong rally to break the double top and test the 1.2000 psychological mark. However, the seasonality impact of strong USD in September may not allow this to happen while we anticipate this scenario for the next month’s projection.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.