- The EUR/USD pair shows the biggest daily losses in two weeks, breaking the downtrend after three days.

- Federal Reserve hawks have hope ahead of the Fed meeting next week as US Treasury yields rise.

- With a sluggish session and mixed sentiment, ECBSpeak creates trading barriers.

- The German inflation data and US housing data will brighten the calendar, but bond changes and risk catalysts drive the new momentum.

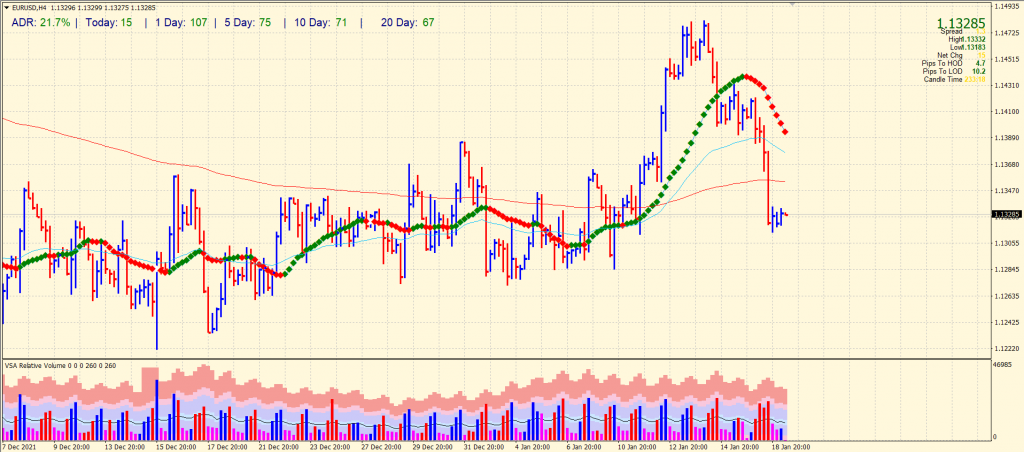

The EUR/USD forecast is bearish as the price plunges below the 1.1400 mark, breaking the key levels amid a stronger US dollar.

After experiencing its worst daily decline in 14 days due to high US Treasury yields, the EUR/USD is licking its wounds above 1.1300. After Wednesday’s pre-European session deadline, the major currency pair climbed 0.10% intraday around 1.1330, the first rise in four days. The recent pullback may be attributed to the reluctance of the US dollar to follow the strength of Treasuries at an all-time high.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

On the other hand, the US dollar index (DXY) is recovering from an intraday low near 95.70, moving away from a weekly high. At the start of the Asian session, the 10-year US Treasury yield hit a two-year high of 1.89%. Moreover, during a four-day uptrend, coupons on other major US bond options, such as the 2-year and 5-year, made new multi-day highs at the start of the Asian session, as well. ECB representative’s somewhat hawkish remarks and weaker US data the day before could account for the pair’s recent recovery.

For the first time in two years, the Empire State Manufacturing Index fell in December, falling from 25.7 to -7.7 vs. 31.9 in experience and 83 in the market forecast.

François Villeroy de Gallo, member of the ECB Governing Council and governor of the French central bank, expects inflation in France to fall below 2.0% by the end of 2022. However, if inflationary pressures are sustained, he noted: “I have no doubt the ECB will adjust monetary policy sooner.”

In reacting to the catalysts above, EUR/USD pays little attention to a Reuters poll that predicts higher eurozone inflation during 2022 than a month ago, which may indicate the European Central Bank is under pressure to tighten policy after the Omicron wave, the pandemic passes.” The market sentiment remains sluggish in search of new clues as futures for shares continue to be offered in the US and the Eurozone.

It will be important to see if the second reading of the German harmonized consumer price index (HICP) confirms the original forecast of 5.7% for December. Following that, the US building and housing permits for the specified month have to be carefully examined to get a clear direction.

Next week’s Federal Open Market Committee (FOMC) verdict will be heavily influenced by Treasury yields and Covid updates.

EUR/USD price technical forecast: Bears pause above 1.1300

The EUR/USD price forecast is extremely bearish as the pair broke below the 200-period SMA on the 4-hour chart. The volume data also shows the bearish bias as the volume for the down bars constantly rose. The average daily range for the pair is 21% so far which shows low volatility for the day.

–Are you interested to learn more about forex brokers? Check our detailed guide-

The pair will attempt to rise as long as it stays above the 1.1300 mark. However, the bullish reversal will only be confirmed if the price sustains above 1.1400. On the flip side, breaking 1.1300 will urge the sellers to target 1.1260.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.