- Demonstrations against COVID restrictions in China have caused market uncertainty.

- Investors are concerned about how Beijing will react to the unrest in China.

- The PBOC will reduce the reserve requirement ratio for banks by 25bps.

Today’s EUR/USD forecast is bearish. The euro fell Monday as demonstrations against COVID restrictions in China shook financial markets. The uncertainty caused investors to flee to the safe-haven dollar, which rose. The COVID protests have erupted across China and spread to numerous cities following a fatal fire in Urumqi in the far west.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Investors were on edge due to concerns about the unprecedented wave of civil disobedience in a nation where in-person rallies are uncommon, the mounting COVID cases, and how Beijing will respond to the crisis.

China’s economy has suffered significantly due to the severe COVID regulations, and officials have taken several steps to boost growth. The People’s Bank of China (PBOC), the country’s central bank, announced on Friday that the reserve requirement ratio (RRR) for banks would be reduced by 25 basis points (bps) as of December 5.

“If the RRR cut is the only monetary policy tool that the PBOC is going to implement, it may not lead to a significant increase in bank lending,” said Iris Pang, chief economist for Greater China at ING.

The most recent developments in China have halted the US dollar’s drop, driven in the previous several weeks by expectations that the Federal Reserve would soon moderate its rate hikes.

EUR/USD key events today

Investors will be paying attention to speeches from ECB officials, including Elizabeth McCaul and President Christine Lagarde. These speeches are known to contain clues on the future of monetary policy.

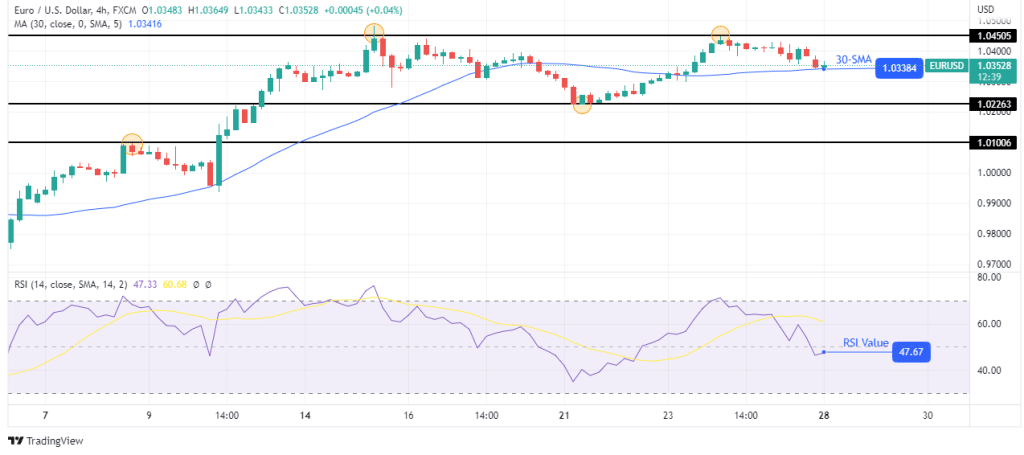

EUR/USD technical forecast: Wobbling in a broad range

Looking at the 4-hour chart, we see the price trading at the 30-SMA and the RSI close to 50. This is a sign that the price is at a pivotal level where either bears or bulls could take over. However, bulls have an advantage as the price will likely use the SMA as support and bounce higher.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

If this happens, bulls will look to retest and possibly take out the 1.0450 resistance level. On the other hand, if bears gather enough momentum for a break below the 30-SMA, the price will likely fall to the 1.0226 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.