- Underlying inflation in the Eurozone may not decline as quickly as some anticipate.

- Core prices in the Eurozone are still increasing.

- Lawmakers are looking for an explanation for SVB’s abrupt demise.

Today’s EUR/USD forecast is slightly bullish. Isabel Schnabel, a European Central Bank board member, said on Wednesday that the bank’s main worry is underlying inflation. Underlying inflation in the Eurozone is proving stubborn and may not decline as quickly as some anticipate.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The 20 countries using the euro currency are seeing rapid declines in overall inflation. However, core prices, which do not include volatile fuel and food prices, are still increasing. This suggests that rapid price growth may prove durable and difficult to reverse.

According to Schnabel, head of the ECB’s market operations, the surge in energy prices last year rapidly permeated the rest of the economy, but the reversal may take longer.

Although the ECB has not given any guidance for its meeting on May 4, chief economist Philip Lane said more rate increases would be necessary if recent market volatility subsides.

Since July, the ECB has raised its benchmark deposit rate by 350bps to 3%.

The head of the banking system told US legislators that bank executives, Federal Reserve supervisors, and other regulators are all to blame for Silicon Valley Bank’s failure. The lawmakers were looking for an explanation for the lender’s abrupt demise.

The failures of SVB and Signature Bank sparked a larger decline in confidence in the banking industry. This devastated stocks and fueled worries of a full-blown financial crisis.

EUR/USD key events today

The United States will release a Gross Domestic Product report for Q4. Investors expect the GDP to hold at 2.7%. There will also be an initial jobless claims report showing the state of the labor market.

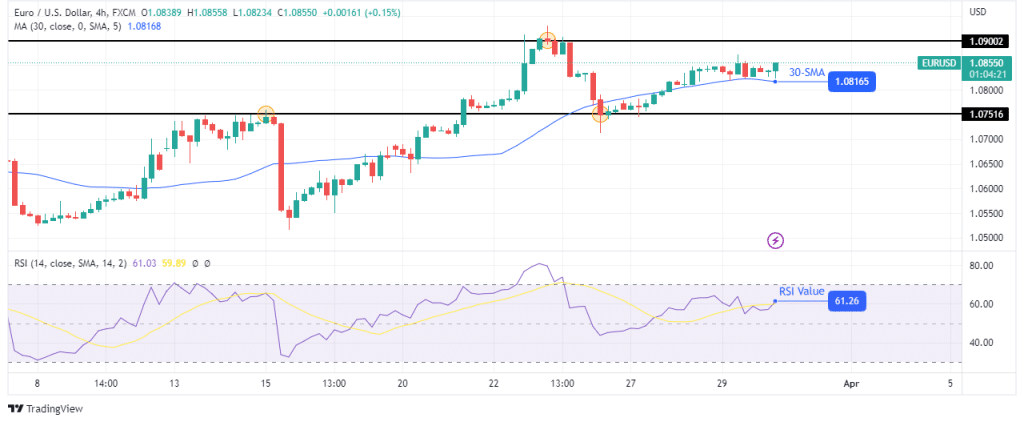

EUR/USD technical forecast: Bulls ride on 30-SMA support

The 4-hour chart shows EUR/USD slightly above the 30-SMA with the RSI above 50. This indicates the current move is bullish. However, bulls are not committing to big moves away from the SMA. This sign of weakness might allow bears to break below the SMA.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The price is also trading between the 1.0900 resistance and the 1.0751 support. If bulls come back stronger, the price will retest the resistance. On the other hand, if bears take over, it will retest the support.

Looking to trade forex now? Invest at eToro!