- US producer prices rose less than anticipated in October.

- Inflation in the US is showing signs that it has peaked.

- The ECB will likely keep raising rates over 2% to tame high inflation.

Today’s EUR/USD forecast is bullish as inflation peaks in the US. In October, US producer prices rose less than anticipated, proving that inflation was beginning to decline. The Labor Department said on Tuesday that the producer price index for final demand increased 0.2% last month. Analysts had forecasted the PPI would rise to 0.4%.

–Are you interested in learning more about STP brokers? Check our detailed guide-

According to data released last week, consumer prices increased less than anticipated in November, bringing the annual increase below 8% for the first time in eight months.

Although the European Central Bank (ECB) is likely to keep raising interest rates over 2%, according to France’s central bank chief, “jumbo” rate hikes won’t become a new habit. The ECB has raised rates at the swiftest rate on record, with a total increase of 200 basis points to 1.5% in three months. Despite the quick pace, investors still anticipate that the bank will increase rates more to curb high, widespread inflation.

“We are approaching what I would call the ‘normalization range,’ which can be estimated at around 2%. We should reach this level by December,” French central bank governor, Francois Villeroy de Galhau, said in a speech at a financial conference in the Japanese capital on Tuesday.

He added that indications of peaking headline and core inflation in the United States were “excellent news” for everyone, given that the world’s top economy has been at the forefront of the global inflation cycle.

EUR/USD key events today

Investors will be keeping a close eye on the retail sales report from the United States. They will also listen to ECB president Christine Lagarde, set to speak later today.

EUR/USD technical forecast: Bullish bias remains strong

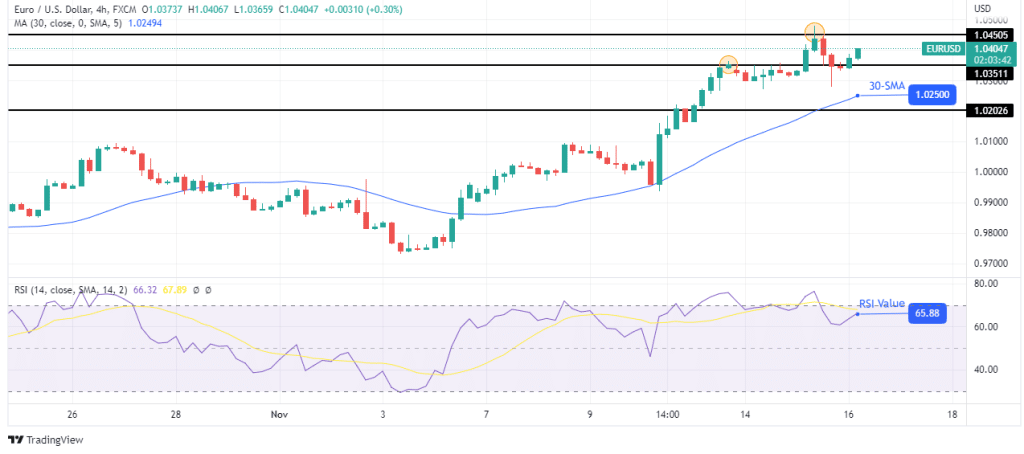

Looking at the 4-hour chart, we see the price trading above the 30-SMA and the RSI above 50, showing bulls are ahead. The price pulled back after finding resistance at the 1.0450 level.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

There was a small consolidation at the 1.0351 support level, where the pullback paused before the bulls returned. Bulls will now be looking to hit a new high above 1.0450. A break below the 1.0351 level could mean retesting the 30-SMA as support before the bullish trend continues.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.