- The US Federal Reserve appeared close to ending interest rate hikes.

- The Fed increased its benchmark funds rate by 25 basis points.

- European markets predict another 50 bps or so to go.

Today’s EUR/USD forecast is bullish. The dollar was under pressure on Thursday, trading near seven-week lows, after the US Federal Reserve appeared close to ending interest rate hikes.

-If you are interested in forex day trading then have a read of our guide to getting started-

The Fed increased its benchmark funds rate by 25 basis points as anticipated. Instead of stating that “ongoing increases” are required, it stated that “some additional” hikes may be necessary. The Fed will monitor how the banking crisis affects the economy.

Futures only predict a 50/50 possibility of one more hike, unlike European markets that predict another 50 bps or so to go. The disparity has caused the euro to soar. On Wednesday, it reached a seven-week high of $1.0912.

According to Brian Daingerfield, head of G10 FX strategy at NatWest Markets, the Fed’s new tone makes it less likely that the markets will start to worry again that strong economic data will raise interest rates.

“From the standpoint of foreign exchange, we believe that argues for further dollar weakness as the Fed cycle’s ceiling has fallen.”

According to Fed Chair Jerome Powell, deposit flows have stabilized over the past week. Smaller lenders also expressed relief over Yellen’s comments that deposit insurance will be considered in the event of a contagion risk.

The dollar had just regained footing when US Treasury Secretary Janet Yellen shocked the markets by telling Congress she had not considered or discussed blanket bank deposit insurance. However, that mostly reversed on Thursday.

EUR/USD key events today

Investors will pay attention to the EU leaders’ summit, housing data from the US, and the initial jobless claims report from the US.

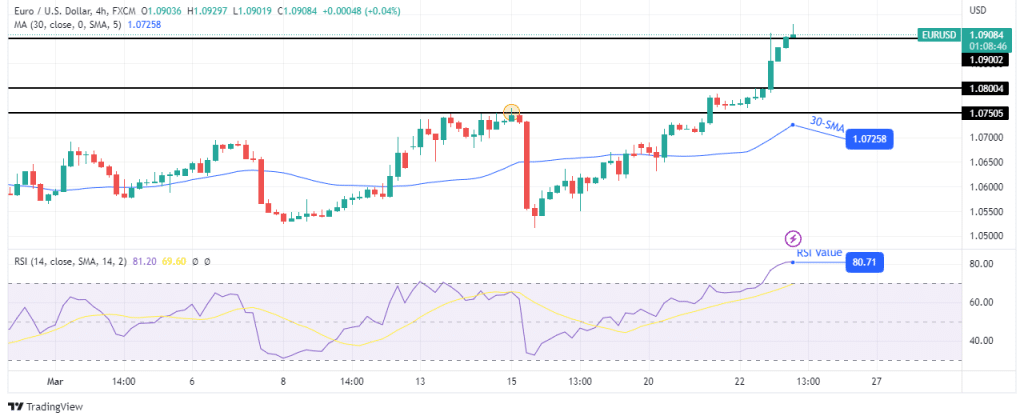

EUR/USD technical forecast: Bulls charge through resistance levels

After a sharp bullish move, the 4-hour chart shows EUR/USD trading slightly above the 1.0900 key level. The price is trading well above the 30-SMA, and the RSI is firmly in the overbought region. Bulls have a lot of momentum and are much stronger than bears.

-Are you looking for automated trading? Check our detailed guide-

The price broke above the 1.0800 key level without pause and is now facing the 1.0900 key level. We might see a break above this level, given the strong bullish momentum. At the same time, we might get a consolidation before the uptrend continues.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.