- Eurozone business activity contracted in July.

- Consumers in the Eurozone are spending less due to rising inflation.

- Investors are getting more concerned about Europe’s economic outlook.

Today’s EUR/USD forecast is slightly bearish after data released on Friday showed a decrease in business activity in the Eurozone for July. Consumers in the Eurozone are cutting back on spending due to rising prices.

–Are you interested to learn more about forex options trading? Check our detailed guide-

This reduced spending has affected both the manufacturing and services sectors. The S&P Global’s flash Composite Purchasing Manager’s Index (PMI) came in below 50 at 49.4 from a previous 52.0 in June. This data is a good indicator of overall economic health.

“The eurozone economy looks set to contract in the third quarter as business activity slipped into decline in July and forward-looking indicators hint at worse to come in the months ahead,” said Chris Williamson, chief business economist at S&P Global.

“Excluding pandemic lockdown months, July’s contraction is the first signaled by the PMI since June 2013, indicative of the economy contracting at a 0.1% quarterly rate.”

The ECB raised interest rates by a surprise 50bps which shows the central bank is now more concerned about rising inflation at the expense of growth.

“Business expectations for the year ahead have meanwhile fallen to a level rarely seen over the past decade as concerns grow about the economic outlook, fuelled partly by rising worries over energy supply and inflation but also reflecting tighter financial conditions,” Williamson said.

EUR/USD key events today

Data just released shows a drop in German business expectations from a previous 85.5% to 80.3%. The German Ifo Business Climate Index also dropped from 92.2 to 88.6. These releases further show the bleak economic outlook for Eurozone countries.

Investors are also expecting the 2-year note auction rate from the United States.

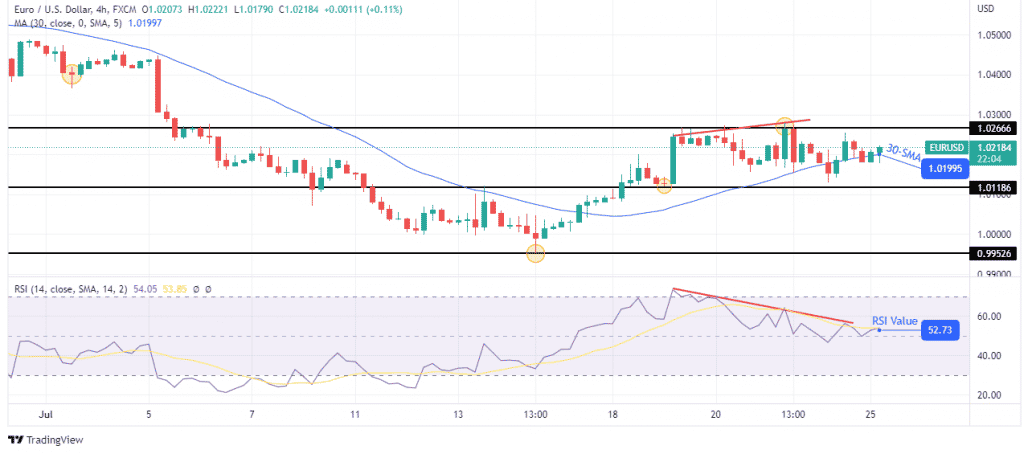

EUR/USD technical forecast: RSI divergence to confirm bearishness

The 4-hour chart shows a bearish divergence in the RSI, which is a sign of weakness in the bullish trend. The price is hanging on to the 30-SMA, also showing bulls are not strong enough to push the price in a steep move up.

–Are you interested to learn about forex robots? Check our detailed guide-

The price needs to break and trade below the 30-SMA to confirm this possible change in sentiment. However, a break above the 1.02666 resistance level will resume the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.