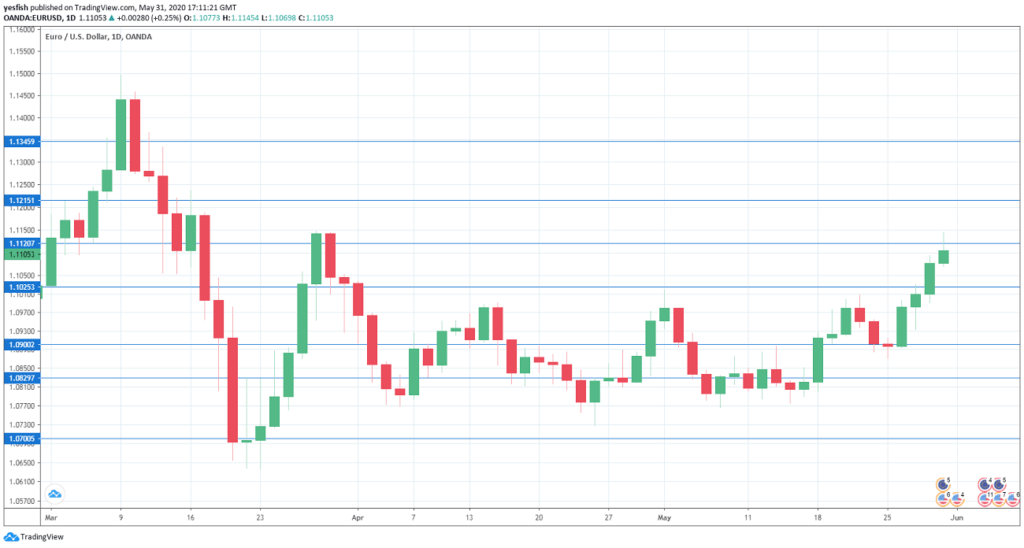

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Tuesday: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector slipped to 30.8, down from 45.7 points beforehand. The estimate for May stands at 38.5. The Italian and French PMIs are also expected to rebound, with forecasts of 35.5 and 40.3 points. The German indicator has been in contraction since January 2019 and is expected to improve to 36.8 points. The eurozone PMI slipped to 33.4, but is expected to improve to 39.5 in May.

- German Unemployment Change: Wednesday, 7:55. The German locomotive has been sputtering. Germany’s jobless claims soared to 373 thousand in March, crushing the estimate of 75 thousand. Another huge figure is expected in April, with a forecast of 188 thousand.

- Services PMIs: Thursday, 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. The services sector continues to show significant contraction throughout the eurozone. The German PMI is expected to come in at 31.4 and the eurozone figure at 28.7 points – both figures are projected to confirm the initial read. The French estimate stands at 29.4, which is also expected to confirm the initial figure. In April, the Spanish and Italian PMIs came in at 7.1 and 10.8 respectively. Both are projected to improve to the mid-20s in May.

- Retail Sales: Thursday, 9:00. Eurozone retail sales have buckled as the eurozone consumer has slashed spending. Retail sales fell by 11.2% in March and April is expected to be even worse, with an estimate of -18.0 percent.

- ECB Rate Decision: Thursday, 11:45. Policymakers are expected to maintain interest rates at a flat 0.00%. Investors will be keenly interested in the rate statement, given the severe economic conditions gripping the eurozone.

- Germany Factory Orders: Friday, 6:00. The manufacturing sector has been heading sharply lower. Factory orders fell by 15.6% in March, and the April reading stands at -20.0 percent.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1345.

1.1215 has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) has switched to support for the first time since January.

1.0900 is next.

1.0829 is the final support level for now.

.

I remain neutral on EUR/USD

The eurozone remains in poor economic shape, but the euro has managed to take advantage of weak U.S. data, such as first-quarter GDP. We can expect further volatility from EUR/USD in the coming weeks, as both the U.S. and Europe continue to grapple with economic uncertainty.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe Trading!