- French Final CPI: Tuesday, 7:45. Inflation in the eurozone’s number two economy is expected to confirm the initial estimate of -0.1%. This decline comes after three straight gains of 0.2%.

- German ZEW Economic Sentiment: Tuesday, 10:00. Confidence amongst financial experts has been accelerating, and the upward trend is projected to continue in March, with a forecast of 74.2.

- Inflation Report: Wednesday, 10:00. There are growing concerns that eurozone inflation is rising, and this was alluded to by ECB President Lagarde in her decision to buy more Euro-bonds. The final readings for February are expected to confirm the initial estimates of 0.9% for headline CPI and 1.1% for Core CPI.

EUR/USD reversed directions last week, posting slight gains. There are three events on the calendar this week, including Eurozone CPI. Here is an outlook at the highlights and an updated technical analysis for EUR/USD.

The ECB policy meeting was a significant one, with the bank announcing that it would accelerate its purchase of Eurobonds under its emergency PEPP program, in response to rising yields. The ECB did not specify the amount or time frame of the new purchases. The euro’s response to this move was muted.

German Industrial Production contracted by 2.5% in January, its first decline in five months. There was better news from Eurozone Industrial Production, which rebounded with a gain of 0.8%, up from -1.6% beforehand. Eurozone GDP for Q4 was revised downwards to -0.7%, down from -0.6%.

.

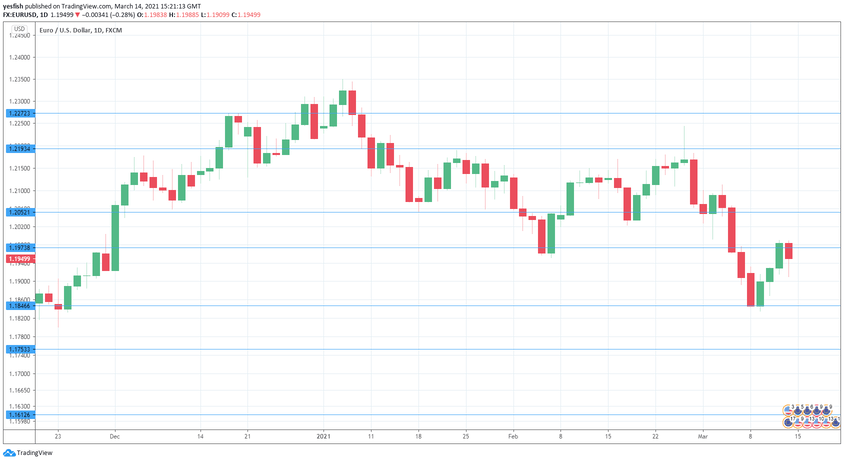

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

.

Technical lines from top to bottom:

We start with resistance at 1.2272.

1.2193 is an important monthly resistance line.

1.2052 is next.

1.1973 is an immediate resistance line.

1.1846 (mentioned last week) is the first support level.

1.1667 is the final support line for now.

.

I remain bearish on EUR/USD

The eurozone continues to struggle, with a weak economy and a sluggish vaccine rollout in response to Covid-19. The US recovery has been deepening and the massive Biden stimulus plan is expected to boost the domestic economy.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!