- The EUR/USD is floating in a tight range around 1.0400 after a slight recovery.

- Dollar bulls focus on Michigan’s CSI release.

- Fed Powell unexpectedly added an alternative to two more massive rate hikes this year.

During the Asian session, the EUR/USD forecast recovered but lost some momentum afterwards. Despite a drop in the US Dollar Index (DXY), the pair is trading in a slightly lower range, around 1.0400.

–Are you interested in learning more about STP brokers? Check our detailed guide-

On Thursday, Euro bulls fell sharply after the US Bureau of Labor Statistics released producer price index (PPI) data. The US Producer Price Index was 11%, versus 10.7% expected on an annual basis. The strengthening dollar provides a reliable indicator of commodities inflation.

In a recent interview with Marketplace, Federal Reserve Chair Jerome Powell hinted at the possibility of two more straight-line rate hikes at the next policy meeting.

The ongoing phase of aggressive rate hikes is now adding to the uncertainty in the currency area after the market had expected another massive rate hike soon after the 50 basis points (bp) announced in the first week of May.

In the meantime, euro-bulls continue to discuss an embargo on Russian oil imports. The German government abruptly dropped its objections to an oil embargo from Russia. Still, the European Union (EU) faces supply chain shortages, oil production cuts, and unemployment concerns to announce an imminent embargo.

In today’s session, we will be focusing on the Michigan Consumer Sentiment Index (CSI). Catalyst should land at 64 instead of 65.2 previously. Exceeding Michigan CSI data may fuel dollar bulls.

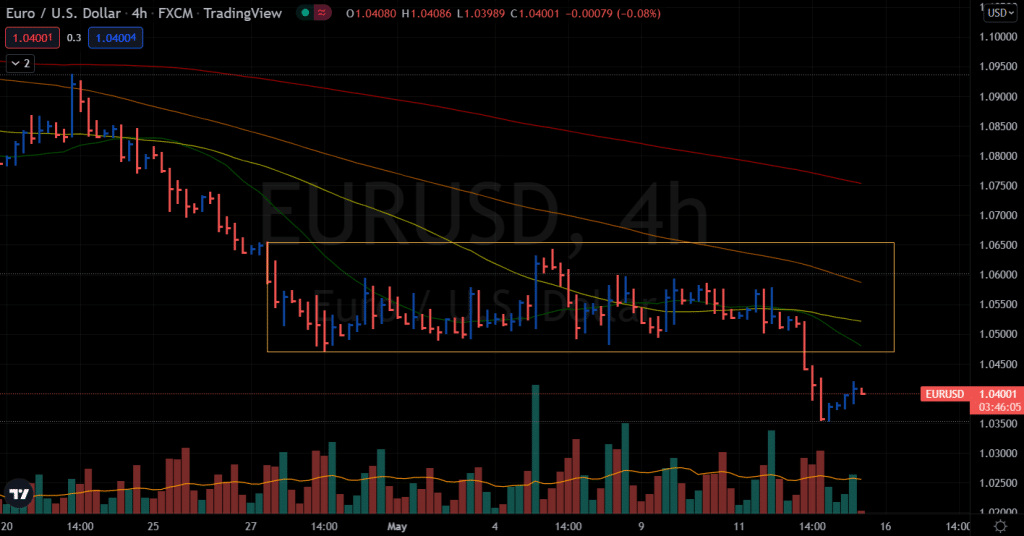

EUR/USD price technical forecast: Stuck around 1.0400

The EUR/USD forecast remains bearish despite the recent recovery as the 4-hour chart shows very tiny bullish price bars. Moreover, the volume for those bars is also below average. However, the price may test the 1.0470 area, which is the broken range of the pair. As a result, the pair may resume the downside from those levels.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, if the price breaks the 1.0500 level, we may assume that a bullish reversal has occurred. Although the price went up to 1.0600 but could not maintain the gains and fell, the probability of trend reversal will be higher as the pair is still above the 2017 lows.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money