- EUR/USD pares gains partially ahead of ECB.

- The ECB is expected to change its stance hawkish stance amid war.

- Russia-Ukraine peace talks remain the key driver of risk sentiment.

The EUR/USD price forecast is neutral to bearish as the pair’s recovery halted near 1.1100 on Wednesday while expecting a dovish ECB. The EUR/USD price is slowly recovering from 1.0806, the lowest level since May 2020. However, the main pair remains vulnerable.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Meanwhile, Western sanctions against Russia have led to a spike in oil and gas prices resulting from the Ukrainian crisis. As a result, ECB’s task has been made harder because energy prices have pushed inflation to a record high of 5.8% in the Eurozone, which is likely to push Russia into further aggression.

While the Eurozone economy grew by 0.5% in the last quarter of 2021, thanks to the reversal of Omicron Covid, the US economy grew by 0.8% in the same quarter. However, due to the war, the outlook for the economy looks rather bleak for the next few quarters.

ECB and risk sentiment

In this context, the ECB may be forced to abandon its hawkish stance in favor of a wait-and-see approach and refrain from deciding when to hike rates or end the APP program.

The ECB’s stance could be seen as dovish since markets have already begun delaying the possibility of a first post-pandemic rate hike until early 2023 on an annualized basis. A December launch was previously expected.

Risk appetite will remain dominant in the Russian-Ukrainian conflict that led to this Thursday’s showdown with the ECB.

The ECB’s neutral stance is likely to throw the hawks out the window, despite the high degree of uncertainty that comes with war.

EUR/USD price technical forecast: Bulls to defend 1.1000

Technically, the EUR/USD pair may retest multi-month lows around 1.0800, below which the fall could extend to the May 2020 low at 1.0766. In contrast, any upward movement will likely meet strong resistance near the 1.1100 round figure.

However, the pair has maintained above the 20 and 50 SMAs on the 4-hour chart. The volume data support the bulls and may help the pair retain its acceptance above the 1.1000 mark. But recent consolidation remains a question mark on the pair’s bullish trend.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

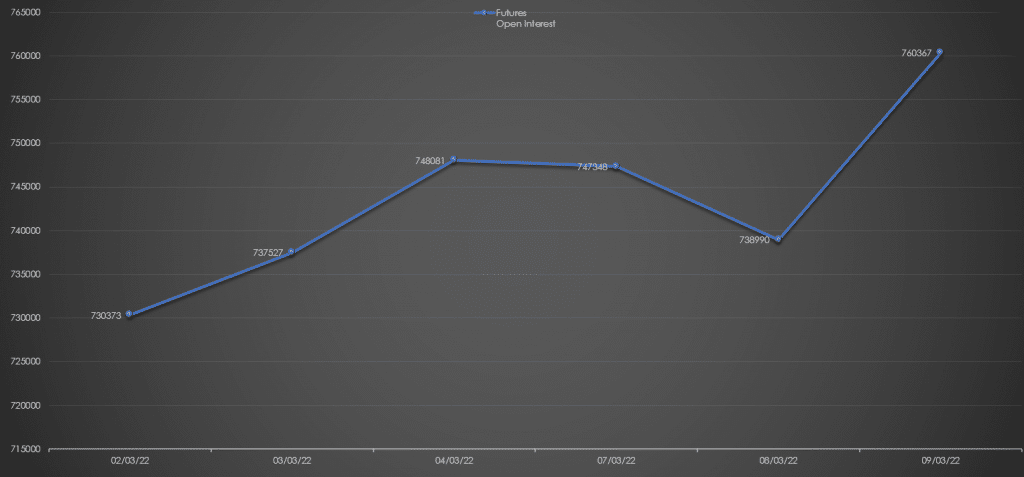

EUR/USD forecast via daily open interest

The open interest for the EUR/USD showed a remarkable increase yesterday while the price also saw a rise of 200 pips. It shows a bullish bias for the pair.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money