- EUR/USD recovers a bit after falling close to the two-year low.

- The greenback took a breather as it inched closer to the 101-level.

- Without any major event for today, the focus will be on ECB’s dovish stance and the overall greenback’s strength.

The EUR/USD forecast during the London session is mixed as the pair is trying to recoup some of its losses, but the broader sentiment remains red amid a stronger greenback.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The see-saw

Following three successive daily downturns, including a dip to levels last seen over two years ago at 1.0750, the EUR/USD regains some positive impetus and flirts with the 1.0800 mark.

The ECB’s stance

The EUR/USD has remained susceptible in recent trading sessions as the European Central Bank maintained its status quo by maintaining policy rates steady.

After realizing the Eurozone’s increased inflation levels and stalled growth rate due to the Ukraine conflict, the ECB chose to bite the bullet and keep interest rates steady in a neutral direction.

Greenback inching closer

The DXY is approaching 101.00 due to increased bets on the Fed’s tight monetary policy. On Monday, St. Louis Fed President James Bullard indicated that a 3.5 percent interest rate is the bare minimum that must be attained this fiscal year.

The embargo on Russian oil

Today, French Finance Minister Bruno Le Maire announced that a European Union-wide ban on Russian oil is in the works, stressing that France’s President Emmanuel Macron supports such a step.

EUR/USD data events ahead

We don’t have anything significant from the Eurozone.

Meanwhile, we have Fed Bullard and Evans’s speeches on the US doc. This can give fresh impetus to the greenback.

What’s next to watch for EUR/USD forecast?

Despite the current rally, the view for the pair remains negative for the time being, owing to dollar fundamentals and geopolitical worries.

EUR/USD technical forecast: Downside remains capped for now

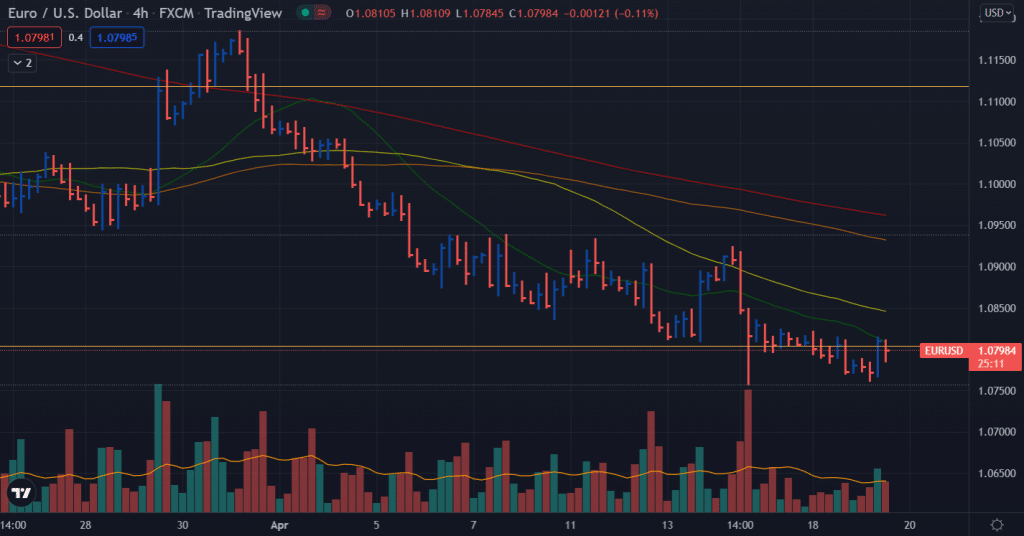

The EUR/USD price is hovering just below the 1.0800 level. At the time of writing, it is trading at 1.0793, with an increase of 0.11%.

On the 4-hour chart, 20, 50, 100, and 200 SMAs are above the price. It signifies a bearish trend.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The next key support level for the Fiber is 1.0779. If the price goes above this level, it can further move towards 1.0760.

On the other hand, the next resistance is at 1.0845. If the price goes above this level, we can see it further rising towards the 1.0861 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money