- EUR/USD remains silent, under pressure near 50-period SMA.

- The EU PMIs are expected to beat the estimates, providing room to the ECB for a rate hike.

- Bloomberg predicts a hike in swap rates by 10 bps, but Chief economist Lane criticized it because of negative implications.

The EUR/USD forecast looks towards the downside as price action is too weak. However, the key data releases today can turn the upside down.

-If you are interested in high leveraged brokers, check our detailed guide-

At the time of writing, EUR/USD trades in the 1.1625 area, with a narrow range between 1.1622 and 1.1628 in Tokyo. Asian markets are relatively quiet today. However, traders could still encounter some volatility at the end of the week due to a series of key data announcements in the European and US markets.

Like the UK and the US, the euro area is experiencing escalating inflation due to supply chain disruptions and skyrocketing energy prices. Therefore, the upcoming Markit manufacturing indices for Europe and Germany in October may have significant implications for policymakers at the European Central Bank.

According to past data, the eurozone economy performed well in the second and third quarters. However, growth is expected to peak during this period, presenting ECB with new challenges. In October, Westpac analysts predicted that service PMIs would remain strong and Delta would be less of an issue for the region. Despite global uncertainty and a delta that poses higher risks for US activity, analysts expect manufacturing and services PMIs to return to normal levels in October.

On the other hand, the market night overestimates the chances of an aggressive central bank. Chief economist Lane spoke out against the hike of market prices related to ECB tightening earlier this week. However, Bloomberg predicts a tightening of swap rates by 10 basis points over the next year.

According to Lane, the forward yield curve indicates that some market sentiment may be difficult to reconcile with our fairly clear interest rate forecast. He added that the medium-term inflation forecast remains well below the ECB’s target.

The next monetary policy meeting will take place on October 28th, and traders will be looking for some sign of quantitative easing, which is likely to be announced in December. In addition, markets expect a rate cut announcement from the Federal Reserve at its meeting in November. In light of impending stagflation risks, the data leading up to the event will be crucial in providing insight into how the economy is doing.

-If you are interested in MT5 brokers, check our detailed guide-

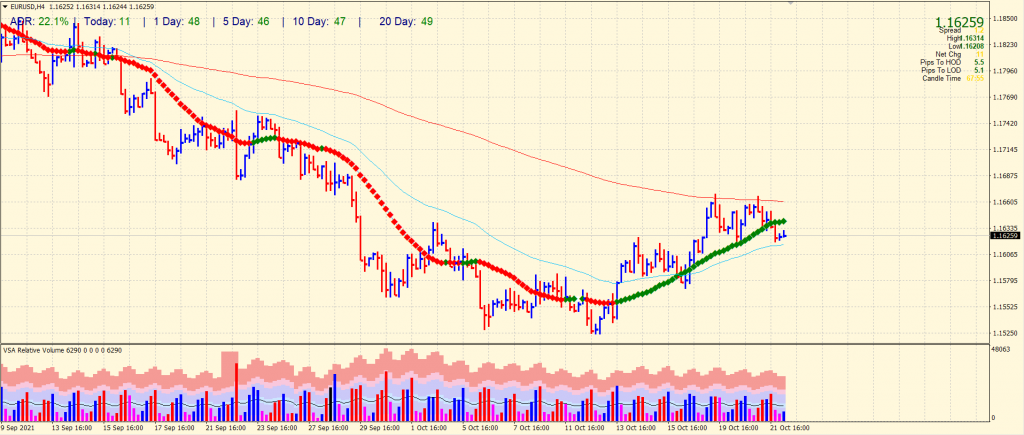

EUR/USD price technical forecast: Looking to test 1.1600

The EUR/USD price forecast seems slightly supported by the 50-period SMA on the 4-hour chart. However, the outlook is not quite encouraging for the buyers. The average daily range is only 22% which is quite low and indicates a silence before a storm. The next support levels are 1.1600 ahead of 1.1570 and then 1.1525. If the buyers emerge here, the first resistance can be seen around 1.1660 ahead of 1.1700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.