- The spread of the Ukraine crisis on the Eurozone economy made the EUR/USD exchange rate fall.

- Markets were relieved amid Powell’s cautiousness on rate hikes.

- Traders are now waiting to see if the second round of negotiations occurs this week.

- Technically, bulls are looking for a catalyst to trigger a meaningful rally.

The EUR/USD forecast is mixed and tilted towards the south amid fearful markets that support the US dollar as a safe-haven asset.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

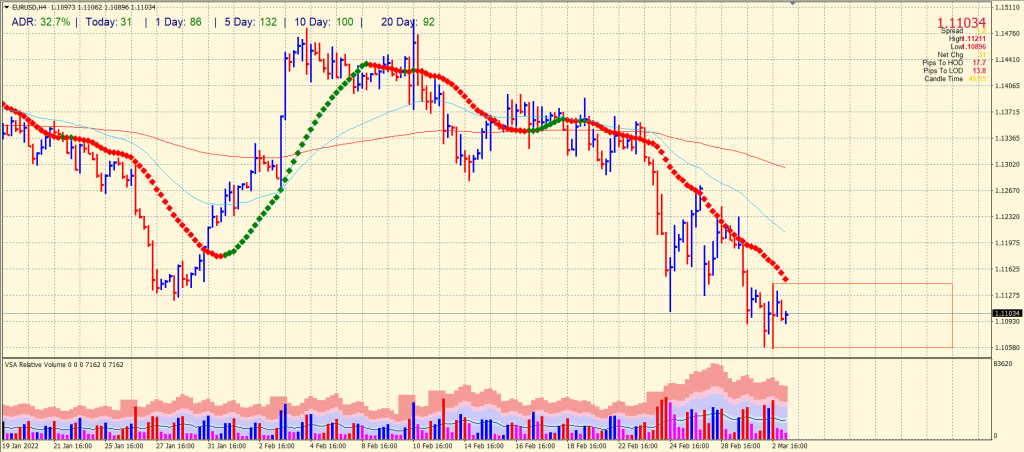

The EUR/USD currency pair is trading at 1.1100 and is down 0.15% at writing. It has fallen from a daily high of 1.1121 to a daily low of 1.1093. In the wake of the Russian invasion of Ukraine, the euro is trending toward a 21-month low.

Nevertheless, the euro exchange rate does not fully reflect the mood of participants on the currency, stock, and commodity markets. In Asia, stocks rose after Fed Chairman Powell said the US economy is strong enough to handle a rate hike and vowed to be cautious about withdrawing support.

Powell told reporters on Wednesday that the central bank will begin raising interest rates “cautiously” this month but will act more aggressively if market prices rise. Markets were thus relieved after a long period of negative news.

In the meantime, James Bullard called for a “quick exit from policy,” while Charles Evans stated that monetary policy is currently “wrong” and should be lifted towards neutrality. At the next meeting, the Lake Forest Lake Bluff Rotary Club Foundation will begin raising rates cautiously and more rapidly if inflation worsens.

Oil and commodity prices have been driven up by the war in Ukraine, and inflation fears have spread worldwide as a result. According to data released on Wednesday, inflation in the Eurozone hit a record high of 5.8% last month. The UN General Assembly has condemned the Russian invasion of Ukraine and emphasized Moscow’s rising isolation on the international stage. In addition, as a result of the US considering tariffs on Russian goods, oil prices are pushed higher. Today, WTI CFDs hit a new high of $113.66.

As the Russian military march continues, reports say five Ukrainian cities are currently surrounded by Russian forces. Earlier this week, the Kremlin announced the capture of Cherson on the Black Sea. Traders are now anticipating the second round of negotiations this week.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

EUR/USD price technical forecast: Bulls preparing for a rise

The EUR/USD price found a strong rejection at 1.1050 area last day and gained the highs around 1.1140 zone. However, the pair could not sustain the gains and closed the bar around the middle. This indicates a bullish reversal pattern as per volume-price studies. It’s a selling climax as the price closes in the middle, the bar is red, and the volume is too high. Now, the only condition is to break the high of the bar to confirm the bullish trend reversal. In that case, 1.1200 will be a key hurdle ahead of 1.1260 and 1.1300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money