- The EUR/USD updates its eight-day low and falls for the fourth day.

- The yield on US 10-year Treasury notes reached a three-year high amid the Fed’s hawkish stance.

- China has announced a new quarantine in response to concerns about regime change in Russia.

- Inflation and geopolitics fueled the fears of a disappointing NFP and dollar rollback.

The EUR/USD forecast remains strongly bearish as the US yields rise amid hawkish Fed and risk-off sentiment while awaiting the US NFP.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

During Monday’s Asian session, the EUR/USD pair reversed a four-day downtrend to please sellers near 1.0950. However, as risk aversion and higher Treasury yields combine, the major currency pair falls to its lowest level in eight days.

US yields continue the upside

During the same period, the US 10-year Treasury notes yield increased 5.4 basis points (bps) to its highest level since May 2019, or 2.54 percent. As a result, the US Dollar Index (DXY) is favored by bond coupons, crossing a three-week-old descending resistance line and reaching 99.15 by the end of the day.

In addition, bond coupon rates are being buoyed by expectations that the Fed will demonstrate aggressive monetary tightening to combat reflation concerns. Based on a 10-year breakeven inflation rate, US inflation expectations reached a record high on Friday, according to the St. Louis Federal Reserve (FRED).

Russia-Ukraine peace talks

A decision on Moscow-Kyiv negotiations will also affect the EUR/USD pair, as buyers of the US dollar seek safe-havens amid tensions between the West and Russia. The White House and Germany sought to allay concerns after statements by Joe Biden suggested an indirect threat to Russian President Vladimir Putin.

The news on the peace talks in Turkey this week was mixed, as Ukrainian President Volodymyr Zelenskyy said that Ukraine would be willing to talk about neutrality and non-nuclear status “if security can be guaranteed.” However, his statements such as “Ukraine will insist on sovereignty and territorial integrity in negotiations with Russia” cast doubt on the chances of success. Furthermore, the market’s risk appetite and the EUR/USD exchange rate reduce negative news from China and Europe about the Coronavirus.

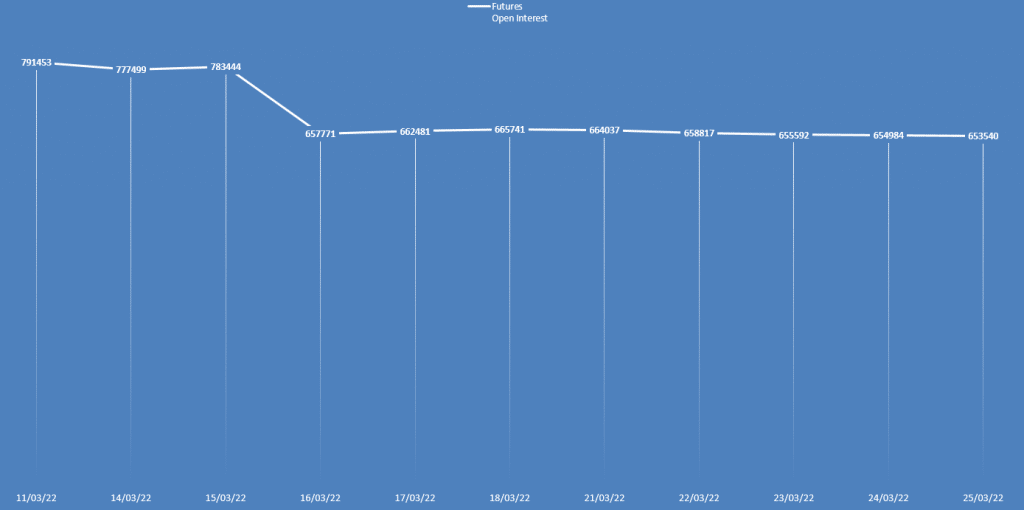

EUR/USD daily open interest forecast

The daily open interest showed no significant change on Friday. Meanwhile, the price also remained in a narrow range. It shows no clear directional bias.

What’s next to watch?

In terms of data, bearish consumer sentiment in the US and housing data are troubling dollar buyers. On the other hand, the latest IFO data from Germany is not optimistic either, giving bears some hope in the EUR/USD pair.

At press time, S&P 500 futures are down 0.35% on the day near 4530, pulling back from a seven-week high.

Amid the recent geopolitical crisis and the Fed’s dovish comments, this week’s US payrolls report has become even more significant. In addition, the EUR/USD market is also vulnerable to risk catalysts, mainly related to Russia and the Coronavirus.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

EUR/USD price technical forecast: Sell-off picks the pace

The EUR/USD price tumbled below the 1.1000 area on Friday. On Monday, the selling exacerbated and broke the triple bottom at 1.0965. The next key support to watch is 1.0900 ahead of 1.0800. If an upside correction occurs, the price rises towards the 1.1000 area. However, the probability of the upside is very thin at the moment.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money