EUR/USD forecast comes with an upside bias. The pair has rebounded as the Dollar Index has turned to the downside. The falling wedge pattern is still valid, but we need confirmation before considering going long. Surprisingly or not, the pair has gained despite the fact that the Euro-zone Industrial Production dropped unexpectedly by 1.0%.

-If you are interested in forex day trading then have a read of our guide to getting started-

It remains to see what will really happen after Powell’s remarks. The greenback has lost significant ground versus its rivals today. It needs strong support from the US economy to be able to take the lead again.

The Unemployment Claims are expected to drop in the previous week from 373K to 350K, while the Industrial Production could increase by 0.6% in June, versus 0.8% in May. Also, you should be careful around the FED Chair Powell Testifies today and tomorrow. The sentiment may change anytime.

Also, better than expected US retail sales reported on Friday could help the greenback to appreciate a little.

EUR/USD technical forecast: Where are bulls heading?

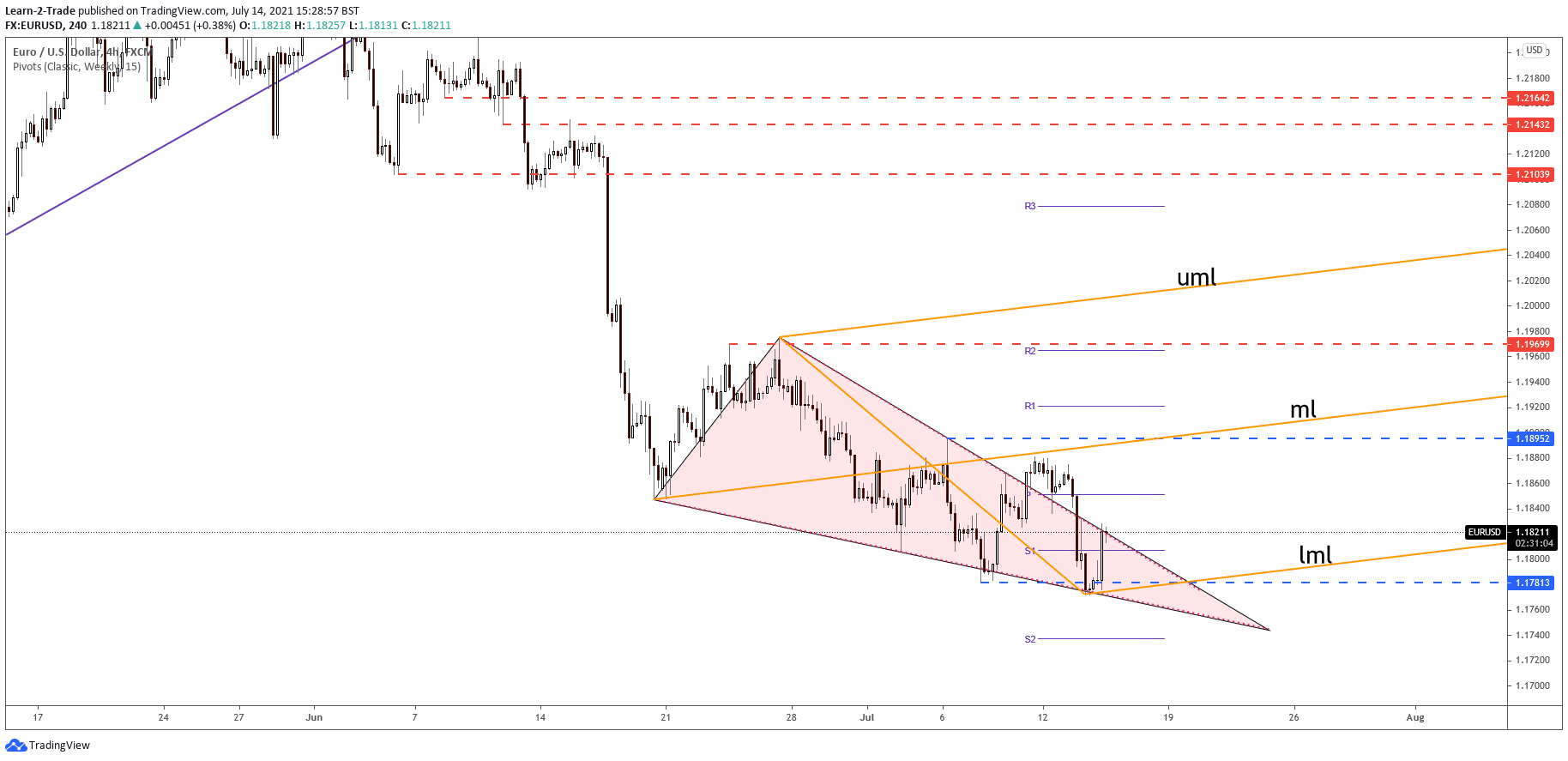

EUR/USD has found strong support on the Falling Wedge’s downside line and now is pressuring the upside line. I’ve drawn an ascending pitchfork, hoping that I’ll catch an upside movement. The pair could increase as long as it stays above the lower median line.

Unfortunately, EUR/USD failed to stabilize above the downtrend line after its previous breakout. Jumping above this dynamic resistance and making a small consolidation within the ascending pitchfork’s body could bring a new long opportunity.

Personally, I really believe that only a valid breakdown through the lower median line (LML) could announce a larger downside movement. Technically, a bullish reversal could be signaled by a valid breakout above 1.1895 and through the median line (ml).

We have a strong negative correlation between the DXY and EUR/USD, so you should keep an eye on the index before making a move in EUR/USD.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.