- EUR/USD fails to recover on Friday and consolidates weekly losses.

- Key data for next week: US CPI.

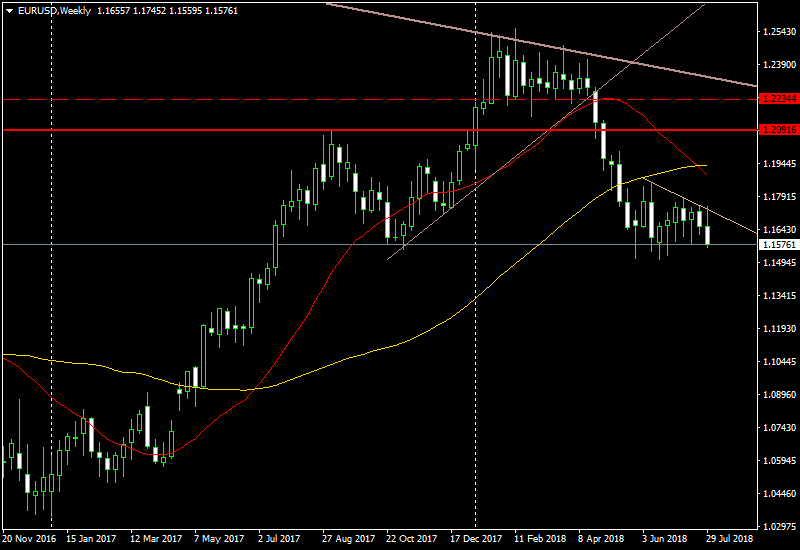

The EUR/USD pair failed to rise above 1.1600 amid a reversal of the US dollar and weakened near the end of the week, moving closer to the 5-week low it reached during the Asian session.

The euro rose to 1.1609 after NFP but if was rejected from above 1.1600. It was about to end the week hovering around 1.1575, posting the fourth consecutive daily decline and the lowest close since June 28.

Despite holding above 2018 lows, the euro is about to post the lowest weekly close since July of last year that could lead to a test of 2018 lows located slightly above 1.1500. As long as EUR/USD remains below 1.1720 the technical outlook favors the downside.

Data review and next week

For next week, the economic calendar shows no key events from the Eurozone. Data during the week showed that GDP growth in the Eurozone decelerated to 2.1% (y/y). “Although the Q2 print came in a bit below consensus estimates, we look for the expansion to remain intact, buoyed by gradually rising wages and a tight labor market. However, inflation remains lackluster and continues to restrain the removal of monetary policy accommodation on the part of the European Central Bank,” said analysts at Wells Fargo.

In the US, the Fed kept, as expected, interest rates unchanged and a hike is expected in September. According to Wells Fargo analysts, the economic data were broadly consistent with a domestic economy that is grinding toward an output gap that is positive rather than negative. “We continue to expect the Fed to hike rates twice more this year in September and December.”

In the US, CPI data is due next week. “Consumer price index could have risen just 0.1% in July, hampered by a decline in gasoline prices. However, due to a positive base effect, the year-on-year rate should remain unchanged at 2.9%. The core inflation rate, for its part, could have increased 0.2% on a monthly basis, allowing the annual rate to remain unchanged at 2.3%. We’ll also keep an eye on the publication of several indicators for June, notably consumer credit, wholesale trade and the Job Openings and Labor Turnover Survey (JOLTS)”, mentioned analysts at National Bank of Canada.