- EUR/USD has hit the highest since August, well above 1.12.

- End-of-year flows and trade optimism are in play.

- US Consumer confidence is the final data point for 2019.

EUR/USD has been having an active New Year’s Eve – hitting a new cycle high at 1.1223, at the time of writing. It last traded at these levels in mid-August. The US dollar has been on the back foot in the last days of 2019, amid end-of-year flows.

The greenback is also suffering a diminishing demand for safe-haven assets. Optimism about a US-Sino trade deal prevails with Chinese Vice Premier Liu He is set to travel to Washington on Saturday for a signing ceremony of the Phase One accord. However, officials in Beijing have yet to confirm the trip.

The US calendar consists of the official House Price Index and the S&P / Case Shiller HPI. The most significant figure due out on Tuesday is the Consumer Confidence gauge by the Conference Board, due out at 15:00 GMT.

Markets are set to quiet down afterward and resume their action early on January 2, 2020, in Asia.

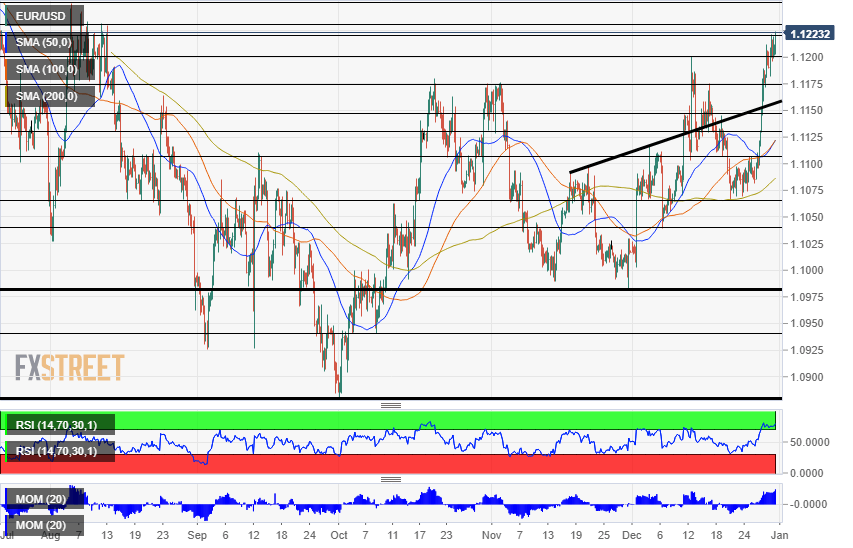

EUR/USD Technical Analysis

Euro/dollar faces resistance at the August peaks of 1.1230 and 1.1250, followed by previous peaks of 1.1325 and 1.1390.

Support lines are aplenty and they include the recent highs of 1.12, 1.1175, 1.1150, 1.1130, 1.1110, and 1.1065.

The Relative Strength Index on the four-hour chart is above 70 – indicating overbought conditions.