- EUR/USD trades on a firm note in the 1.1370 region.

- US CPI, FOMC meeting, Powell’s presser next of note.

- ECB’s VP Luis De Guindos will speak later on Wednesday.

EUR/USD is extending the recovery from Tuesday’s lows in the 1.1250/40 band, regaining more than a cent and shifting its attention to the 1.1370 zone at the time of writing.

EUR/USD now looks to FOMC event

EUR/USD is up for the third session in a row on Wednesday, gathering extra steam always on the back of the continuation of the offered bias hitting the greenback and the improved tone in the risk complex.

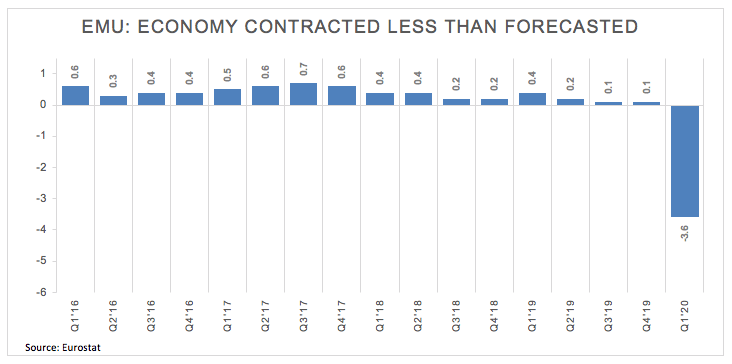

The euro also found extra legs in the recent better-than-expected GDP results in the euro area published on Tuesday, which showed the economy of the region contracted 3.6% QoQ during the January-March period (vs. 3.8% from the preliminary readings).

Later in the session, ECB’s L.De Guindos will speak at a virtual event, while Board member I.Schnabel will speak at an online seminar.

Across the pond, inflation figures tracked by the CPI for the month of May will see the light in the first turn seconded by the more relevant FOMC meeting, Powell’s press conference as well as the revised “dots plot”.

What to look for around EUR

EUR/USD has regained poise after weekly lows in the 1.1250 region recorded on Tuesday. The constructive view in the euro, however, remains well sustained by the gradual and relentless re-opening of economies in Europe and by the ongoing monetary stimulus announced by the ECB, Germany and the European Commission. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.29% at 1.1371 and a breakout of 1.1383 (weekly/monthly high Jun.5) would target 1.1391 (monthly high Jun.13 2019) en route to 1.1412 (monthly high Jun.25 2019). On the flip side, the next support is located at 1.1241 (weekly low Jun.9) seconded by 1.1186 (61.8% Fibo of the 2017-2018 rally) and finally 1.1018 (200-day SMA).