- EUR/USD risk reversals fell to near three-month lows yesterday, signaling a rise in demand for bearish bets (put options).

- Investors added bearish bets even though the US retail sales painted a dismal picture of the world’s largest economy and the US-German bond yield spreads tightened.

- EUR/USD, therefore, is unlikely to see significant gains. Technically speaking, the bias remains bearish while the pair is held below the 200-week moving average (MA).

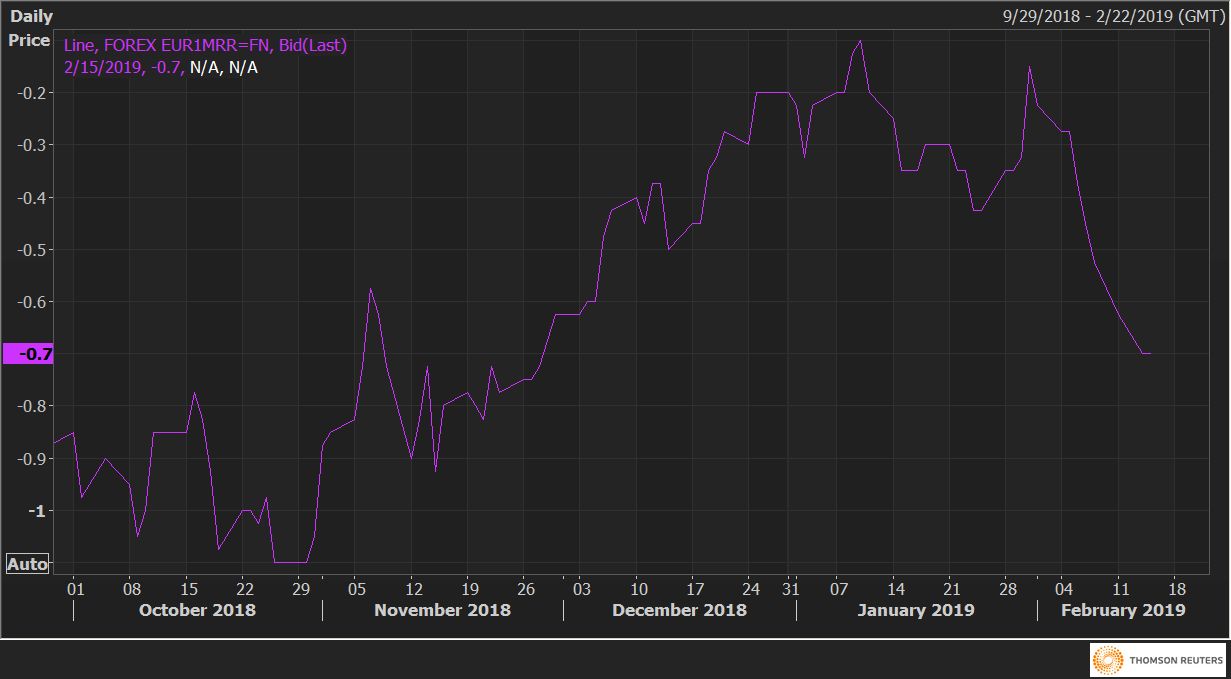

Risk reversals on the EUR, a gauge of puts to calls, fell to their lowest level since November on Thursday, indicating investors are adding bets to position for further weakness in the common currency.

One-month 25 delta risk reversals (EUR1MRR) dropped to -0.70, a level last seen in Nov. 29, from the previous day’s value of -0.675. A negative number indicates the demand (value) for put options (bearish bets) is higher than that for calls. So, the drop from -0.675 to -0.70 means the demand for put options rose yesterday despite weak US data.

The US Commerce Department reported a 1.2 percent drop in retail sales in January (the largest since Q3 2009), reinforcing dovish Fed expectations. The spread between the 2-year US and German bond yields narrowed to 305 basis points from 310 basis points in the EUR-positive manner. Meanwhile, 10-year yield spread also narrowed to 255 basis points from 258 basis points.

Even so, risk reversals dropped in favor of puts. Put simply, market sentiment is bearish on EUR/USD and hence, a bounce, if any, could be short-lived. Validating that argument is the last week’s bearish close below the 200-week MA. That average is currently located at 1.1329 and the bias will remain bearish as long as the spot is held below that key level.

EUR/USD Technical Levels

EUR1MRR