- EUR/USD put (bearish) bias is the strongest in nearly three months.

- The pair risks extending the six-day losing streak on sliding German yields and growth concerns.

- Risk-on, however, could yield a minor corrective bounce.

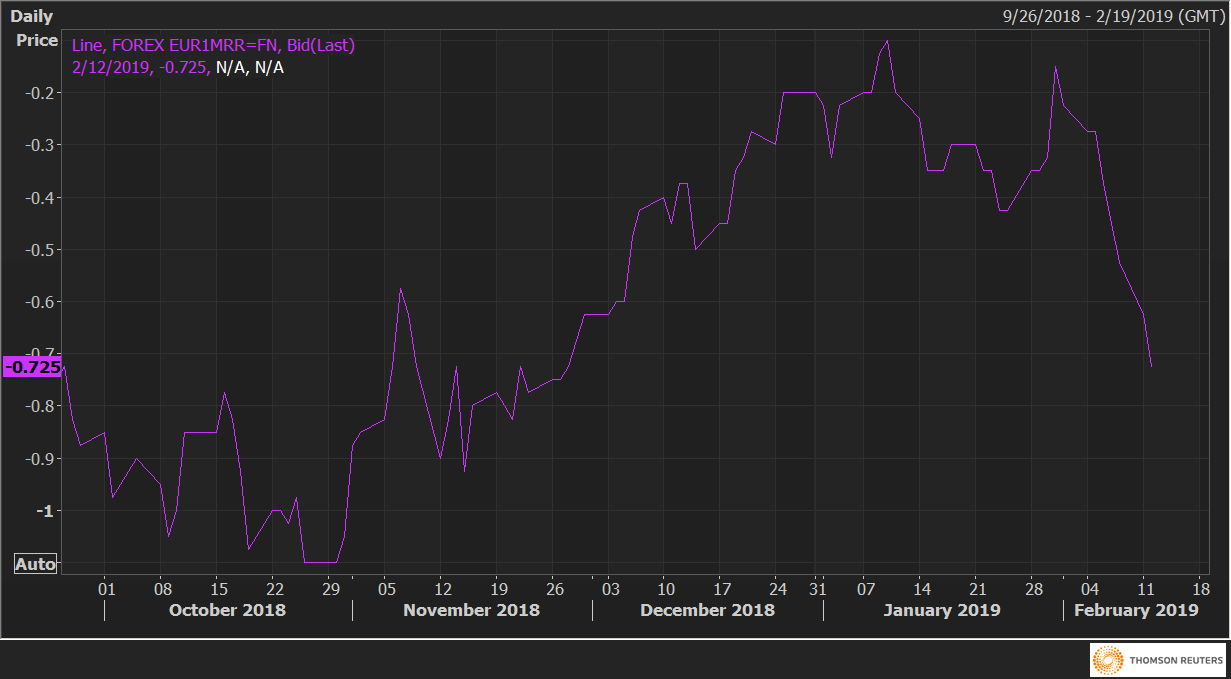

Risk reversals on the EUR, a gauge of calls to puts on the common currency, fell to its lowest level since the end of November, indicating investors are adding bets to position for further weakness in the EUR.

As of writing, one-month 25 delta risk reversals are trading at -0.725 in favor of put options (bearish bets), the lowest level since Nov. 28. Notably, the gauge stood at -0.15 on Jan. 31.

Put simply, investors are expecting EUR/USD to extend the six-day winning streak. After all, the European Central Bank (ECB) rate hike is increasingly looking like a distant dream, courtesy of a sharp slowdown in Germany and other core economies of the Eurozone.

The technicals are also biased bearish: the 5- and 10-day moving averages (MAs) are trending south and the pair closed below the January low 1.1289 yesterday, having breached the crucial 200-week MA support on Friday.

As a result, the November low of 1.1215 could come into play, possibly after a minor bounce, as the risk-on seen in the Asian equities and S&P 500 futures could hit the European shores, leading to broad-based USD weakness.

A drop to 1.125 would also remain elusive if Bundesbank President and ECB member Weidmann downplays recession fears.

EUR/USD pivot points

EUR1MRR