- EUR/USD’s price action remains directionless so far.

- The greenback loses further momentum despite higher yields.

- The NAHB Index, TIC Flow come up next in the docket.

Buyers appear to have regained the upper hand around the shared currency and motivate EUR/USD to keep the buying pressure well and sound near 1.2170 on Monday.

EUR/USD now targets the 1.2180 region

EUR/USD starts the week on a mixed note, fading the initial move to highs near 1.2170 while the downside remains limited by the 1.2130/25 band.

Similar path is navigating the greenback in spite of the mild gains in yields of the key US 10-year note, which fail to extend the rebound further north of the 1.65%.

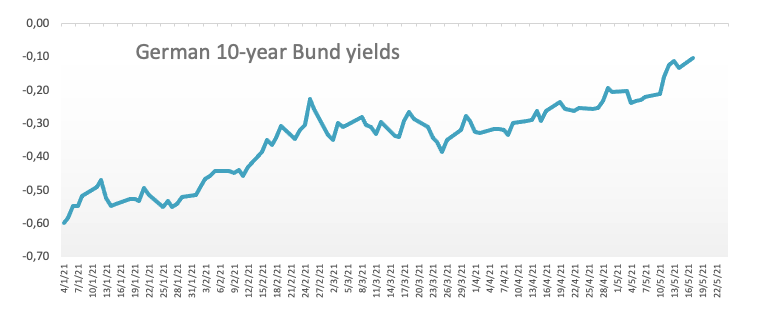

Still in the bonds’ space, yields of the German benchmark 10-year Bund extend the move higher to the -0.10% zone challenging levels last seen in May 2019.

In the US calendar, May’s NY Empire State Index exceeded forecasts at 24.30, although it came in a tad below April’s reading at 26.30. Later in the NA session, the NAHB Index is due followed by TIC Flows.

What to look for around EUR

EUR/USD closed last week on a strong footing well past 1.2100 the figure mainly on the back of the weakness surrounding the dollar and the strong bounce in yields of the German 10-year Bund. The generalized upbeat tone in the risk complex sustained the rebound in the pair, always in combination with the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace and solid results from key fundamentals pari passu with the surging morale in the bloc.

Key events in the euro area this week: Advanced EMU Q1 GDP (Tuesday) – Final EMU April CPI (Wednesday) – German/EMU flash May PMIs, advanced Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

EUR/USD levels to watch

So far, spot is gaining 0.01% at 1.2145 and faces the next hurdle at 1.2181 (monthly high May 11) followed by 1.2243 (monthly high Feb.25) and finally 1.2349 (2021 high Jan.6). On the downside, a break below 1.1985 (monthly low May 5) would target 1.1953 (200-day SMA) en route to 1.1887 (61.8% Fibo of the November-January rally).