- The pair pushes higher on positive German data.

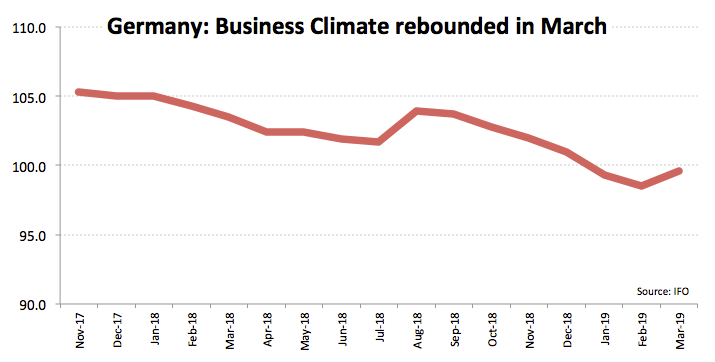

- German IFO surprised to the upside in March.

- Spot met support in the 1.1290/85 band.

EUR/USD is now accelerating the upside and clinches fresh daily highs beyond 1.1320 in the wake of German data.

EUR/USD bid after data

The buying interest around the shared currency continues to pick up pace at the beginning of the week and is now reinforced by the positive surprise from the recently published German data.

In fact, the IFO indicator saw Business Climate, Current Assessment and Business Expectations all coming in above expectations for the month of March, showing a rebound from the recent downtrend.

What to look for around EUR

Market participants have left behind the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends, USD-dynamics and domestic data. Regarding the latter, and looking to the broader picture, the view of a slowdown in the bloc has been ‘confirmed’ last week following disappointing advanced PMIs in core Euroland. This, in turn, should add to the idea of a ‘patient for longer’ stance from the ECB. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is gaining 0.16% at 1.1318 and a breakout of 1.1323 (21-day SMA) would target 1.1359 (100-day SMA) en route to 1.1448 (high Mar.20). On the other hand, the next support emerges at 1.1273 (low Mar.22) seconded by 1.1234 (low Feb.15) and finally 1.1215 (2018 low Nov.12).