- EUR/USD has been extending its gradual grind lower amid Coronavirus fears.

- US-EU trade relations, German ZEW figures, and Trump’s speech are on the agenda.

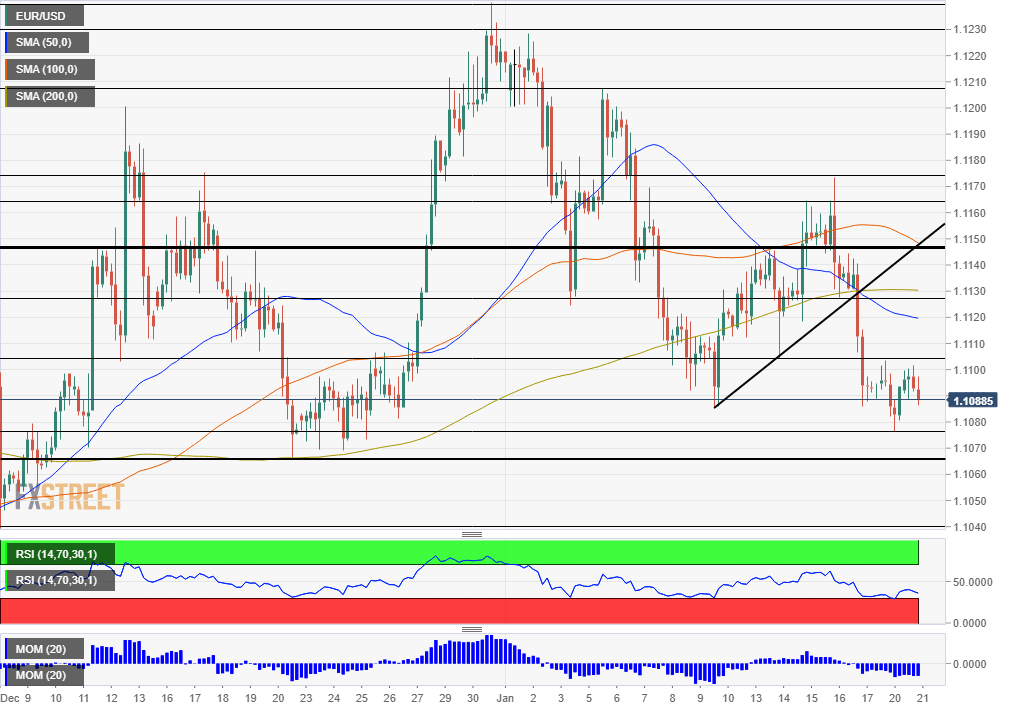

- Tuesday’s four-hour chart is pointing to further falls.

Will EUR/USD bears spread like a virus? The worrying coronavirus strain that has been circulating around China and other Asian countries has infected financial markets. The downbeat mood is boosting the safe-haven dollar – adding to the misery of EUR/USD.

The World Health Organization (WHO) has confirmed that the disease can be spread between humans amid reports of a fourth fatal casualty. Chinese authorities have stepped up efforts to contain the virus ahead of extensive travel expected in the lunar new year.

The dollar had already been gaining ground before the virus’ contagion to financial markets. Last week’s upbeat American figures – inflation, retail sales, and consumer confidence – have kept the greenback bid. The Federal Reserve is unlikely to cut interest rates anytime soon.

On the other side of the pond, tension is mounting toward the European Central Bank’s decision on Thursday. President Christine Lagarde announced a strategic review of the ECB’s policy in her inaugural meeting but refrained from laying out her vision. After accumulating more time on the job, the former Managing Director of the International Monetary Fund may share her opinions on the bank’s next steps.

An indication of the health of the European economy comes from Germany later today. ZEW’s Economic Sentiment indicator is set to continue recovering and hit 15 points in the survey for January. The “locomotive” of the eurozone is stabilizing, and the ECB is trying to assess the extent of this stabilization.

Trump visits Europe

President Donald Trump – who’s impeachment trial begins today – is set to address the World Economic Forum’s gathering at Davos Switzerland. Ahead of the event, Trump met with his French counterpart Emmanuel Macron and both leaders agreed to avoid slapping tariffs on each others’ countries. The US is upset with France’s “tech tax” and had previously threatened to impose levies on French wine, among other products.

The encouraging trade news has done little to support the euro – exposing the common currency’s weakness.

Overall, as US traders return from their holiday, a busy day may see higher volatility.

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart. Moreover, the pair is trading below the 50, 100, and 200 Simple Moving Averages, and the Relative Strength Index is above 30 – outside oversold conditions. To top it off, EUR/USD set another lower low.

Bears are entirely in control.

Support awaits at the fresh low of 1.1075, followed by the Christmas trough of 1.1165. Next, early December’s support at 1.1040 awaits the pair, followed by 1.0985.

Resistance is at 1.1105, Monday’s high, followed by 1.1125, which provided support last week. 1.1145, 1.1165, and 1.1175 were all stepping stones on the way down and now work as resistance.