- Spot struggles for direction around the 1.1300 handle.

- The greenback appears bid near the 96.60 region.

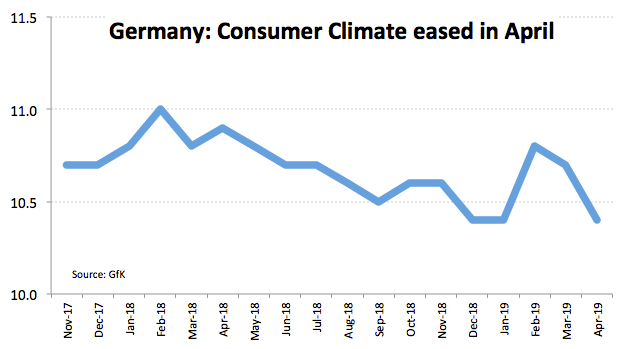

- German GfK Consumer Climate came in at 10.4 in April.

The cautious tone prevails around the European currency during the first half of the week, taking EUR/USD to the 1.1300 region amidst a generalized consolidative theme in the global markets.

EUR/USD looks to risk trends, Brexit

The pair is looking to add to Monday’s gains in the 1.1300 neighbourhood, although a fresh catalyst remains absent following the recent drop to the 1.1270 region in response to poor PMIs in core Euroland.

In addition, the improved sentiment around the greenback in the last couple of sessions has been capping any serious bull run in spot, forcing it to gyrate around 1.1300 the figure for the time being.

Further out, Brexit developments are expected to dictate the sentiment in the broad risk appetite trends. In this regard, UK MPs will now take control of the Brexit process, while parliamentary support for a third meaningful vote appears insufficient.

In the data space, Consumer Climate tracked by GfK deflated to 10.4 for the month of April. Publications across the ocean include the S&P/Case-Shiller index, Housing Starts, Building Permits and March’s Consumer Confidence.

What to look for around EUR

Market participants have left behind the recent and renewed dovish stance from the ECB, focusing instead on the broad risk-appetite trends, USD-dynamics and domestic data. Regarding the latter, and looking to the broader picture, the view of a slowdown in the bloc has been ‘confirmed’ last week following disappointing advanced PMIs in core Euroland. This, in turn, should add to the idea of a ‘patient for longer’ stance from the ECB. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is losing 0.02% at 1.1309 and faces initial support at 1.1273 (low Mar.22) seconded by 1.1234 (low Feb.15) and finally 1.1215 (2018 low Nov.12). On the upside, a break above 1.1357 (55-day SMA) would target 1.1363 (100-day SMA) en route to 1.1448 (high Mar.20).