- The pair remains sidelined around the 1.1630 region on Tuesday.

- The greenback trades with marginal losses above the 94.00 handle.

- Italian politics remain the exclusive driver of the pair so far.

Always vigilant on developments from Italy, EUR/USD has managed to rebound from the 1.1600 neighbourhood – or fresh 2018 lows on Monday – and is now attempting to stabilize in the 1.1630 region.

EUR/USD focused on Italy

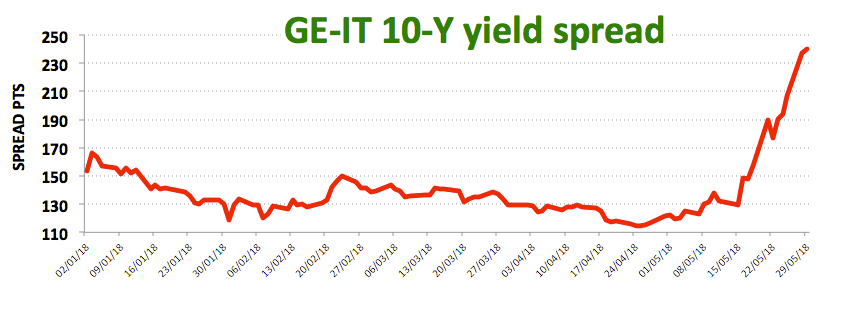

After failing to extend the bull run beyond the 1.1730 area at the beginning of the week, the pair met a wave of selling pressure stemming from the increasing uncertainty in the Italian political scenario and the widening gap between German and Italian yields.

The decline in EUR gained extra traction after PM G.Conte stepped down amidst calls for President S.Mattarella’s impeachment by leaders of the governing coalition M.Salvini and L. Di Maio. The current effervescence in Italian politics will likely derive in snap elections in September/October.

In the meantime, the greenback climbed to fresh YTD tops around 94.50 yesterday amidst thin trade conditions due to the Memorial Day holiday and declining yields as of late.

In the data space, EMU’s M3 Money Supply and Private Sector Loans are due next along with speeches by ECB’s Y.Mersch and S.Lautenschaelager. Across the pond, the Consumer Confidence gauge by the Conference Board will be the salient release seconded by the S&P/Case-Shiller index.

EUR/USD levels to watch

At the moment, the pair is up 0.09% at 1.1636 and a break below 1.1608 (2018 low May 28) would target 1.1600 (psychological level) en route to1.1553 (monthly low Nov.7). On the other hand, the next hurdle emerges at 1.1728 (10-day sma) seconded by 1.1829 (high May 22) and finally 1.1830 (21-day sma).