- EUR/USD once again comes under pressure above 1.20.

- Higher US yields lend support to the dollar on Monday.

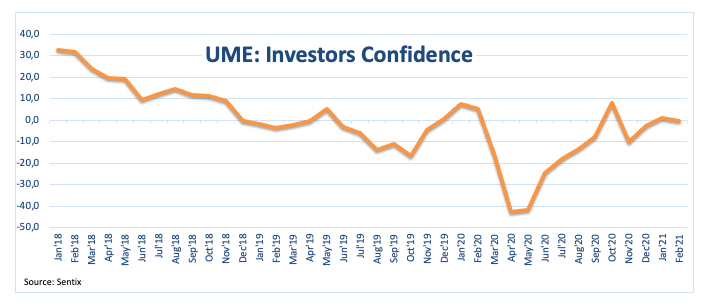

- EMU’s Sentix Index came in at 3.4 in February.

EUR/USD appears to have met some resistance in the 1.2050/60 band amidst a narrow trading range at the beginning of the week.

EUR/USD focused on USD, risk

The resumption of the upside bias in the greenback puts EUR/USD under extra downside pressure at the beginning of the week.

Indeed, the persistent ascent in US yields continues to lend legs to the rally in the greenback and motivates the US Dollar Index (DXY) to regain some upside traction always beyond the 91.00 mark.

In the euro docket, the Sentix Index failed to meet expectations at -0.2 for the current month. Earlier in the session, the German Industrial Production came in flat on a monthly basis during December. Later in the European evening, Chief Lagarde will participate in a debate at the European Parliament.

There are no data releases across the pond, although the attention is expected to be on the inflation figures and the speech by Fed’s Powell (both on Wednesday) and the flash U-Mich index (Friday).

What to look for around EUR

EUR/USD seems to have met decent contention in the YTD lows around 1.1950 so far. In spite of the recent correction lower, the outlook for the pair remains constructive in the longer run and is always supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB along with hopes of an acceleration in the vaccine rollout. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

Key events this week in Euroland: Lagarde will speak on Monday and Wednesday. German final January CPI (Wednesday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention on inflation issues. EU Recovery Fund. Italian politics. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is losing 0.17% at 1.2028 and faces immediate support at 1.1952 (2021 low Feb.5) seconded by 1.1887 (61.8% Fibo of the November-January rally) and finally 1.1694 (200-day SMA). On the flip side a break above 1.2064 (38.2% Fibo of the November-January rally) would target 1.2119 (55-day SMA) en route to 1.2189 (weekly high Jan.22).