- EUR/USD has been consolidating its losses amid growing global tensions.

- US retail sales and consumer confidence are set to move the price today.

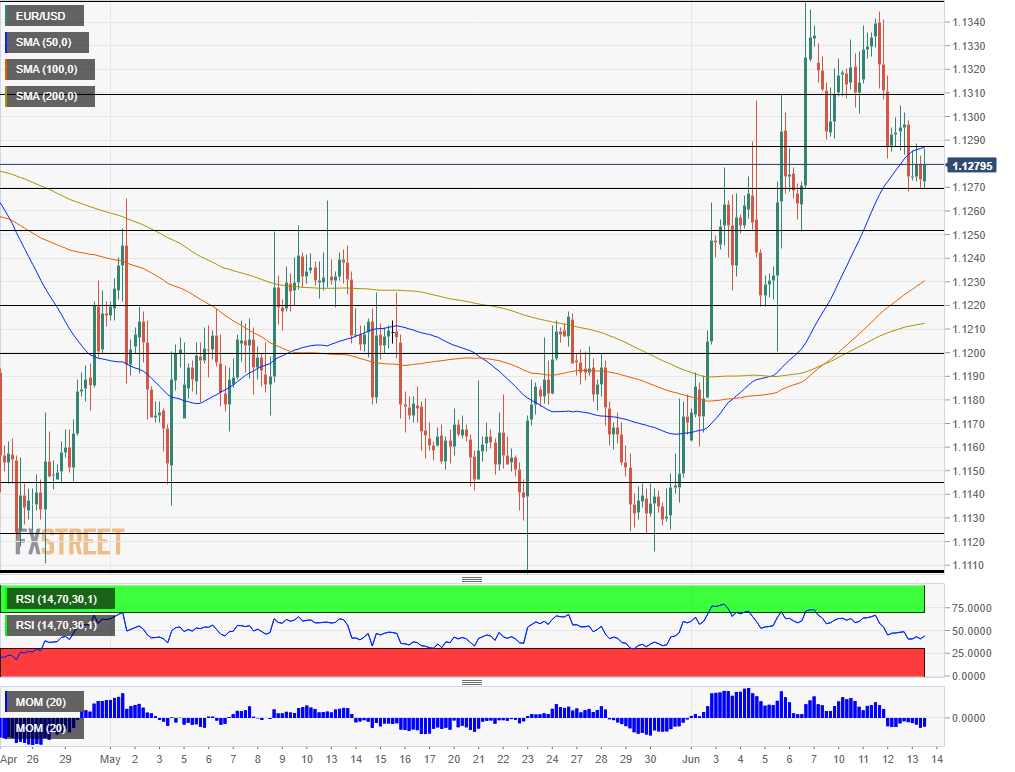

- Friday’s four-hour chart points to further losses for the currency pair.

EUR/USD has been moving slowly in recent days but the direction is clear – down. The world’s most-popular currency pair has been struggling with recent developments in US-Sino trade tensions. White House economic adviser Larry Kudlow said that the US may slap tariffs on China if Presidents Donald Trump and Xi Jinping do not meet at the G-20 summit later this month.

On the other hand, he said that the world’s largest economies are moving in that direction. Walmart, Target, and other retailers have formed an alliance and have warned Trump that duties weigh on the consumer – contradicting the president’s claims that China bears the brunt of the trade war. Fresh Chinese data has been mixed. While industrial production has risen by only 5% compared with 5.5% expected, retail sales have come out at 8.6%, better than 8% projected – and reflecting resilience from the Chinese consumer.

The American consumer is in the spotlight today. US retail sales are forecast to have risen by 0.6% in May while the control group – known as the “core of the core” – carries expectations of advancing by 0.4%.

The US economy is centered on consumption and the publication always moves markets. Today’s release carries extra weight – it is the final top-tier indicators ahead of next week’s Fed decision.

See US Retail Sales Preview: Return to spender

And while the retail sales report provides insights into consumers’ past economic activity, the last word of the week belongs to the consumer confidence survey – a gauge of current activity in June. Also here, expectations are high.

See US Michigan Consumer Sentiment Preview: Happiness and caution

High expectations – or even mediocre ones – risk triggering a negative surprise. The FXStreet Surprise Index has correctly predicted the past two shortfalls in the jobs report and in Wednesday’s inflation data.

Overall, US data is set to dominate EUR/USD price action today.

EUR/USD Technical Analysis

EUR/USD has continued suffering from downside momentum and the Relative Strength Index points is just below 50 – pointing to further falls. Moreover, the pair has slipped below the 50 Simple Moving Average.

Initial support awaits at 1.2770 which has supported EUR/USD today and on Thursday. It is followed by 1.1250, which was a stepping stone on the way up last week. The next lines are 1.1220 that capped it in late May and the post-ECB low of 1.1200.

Some resistance awaits at 1.1290 that was a support line last week and today’s high. 1.1310 was a swing high in early June, and 1.1348 is the highest level since March.