- EUR/USD grinds lower to the 1.0970 region on Thursday.

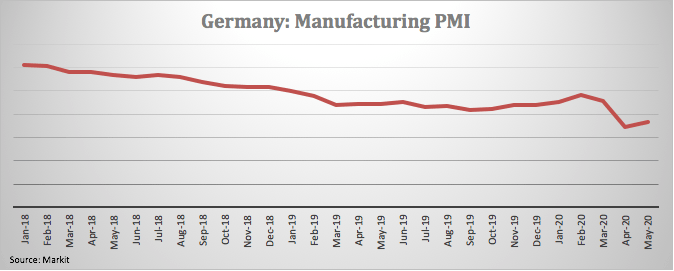

- German flash manufacturing PMI improves a tad to 36.8.

- US Initial Claims will be the most salient event in the NA session.

The midl recovery in the greenback has prompted EUR/USD’s rally to lose some steam and recede to the 1.0970/60 band in the second half of the week.

EUR/USD offered post-PMIs

Following four consecutive daily advances, including a brief test of the 1.1000 neighbourhood on Wednesday, the upside momentum in EUR/USD appears to have run out of vigour somewhat.

In addition, flash PMIS in the core Euroland noted both the manufacturing and services sector in the region are expected to remain depressed and well into the sub-50 region for the month of May, reflecting the impact of the coronavirus on the economy.

Later in the session, investors will closely follow another release of the weekly Initial Claims in the US economy along with the Philly Fed manufacturing gauge and Markit’s preliminary PMIs.

What to look for around EUR

EUR/USD has managed to briefly test the 1.1000 barrier just to ease some ground soon afterwards. In addition, better-than-expected results in Germany and the broader euro area have been also sustaining the strong rebound in the pair along with positive prospects of the re-opening of some economies in the bloc. In the meantime, the solid position of the euro area’s current account keeps deeper pullbacks in the pair somewhat contained for the time being. Meanwhile, in the political scenario, the recent German court ruling against purchases of sovereign debt under the ECB’s QE programme threatens to widen the existing cracks within the euro area and could limit any serious recovery in the currency. This view has been also exacerbated after the French-German proposed fund to help economies to recover from the coronavirus fallout met resistance among some Northern-European members, namely the Netherlands, Denmark and Sweden.

EUR/USD levels to watch

At the moment, the pair is losing 0.07% at 1.0969 and faces immediate contention at 1.0774 (weekly low May 14) seconded by 1.0727 (monthly low Apr.24) and finally 1.0635 (2020 low Mar.23). On the upside, a breakout of 1.0999 (weekly high May 20) would target 1.1013 (200-day SMA) en route to 1.1019 (monthly high May 1).