- EUR/USD sheds further ground and trades near 1.1700.

- Higher US yields continue to support the dollar on Tuesday.

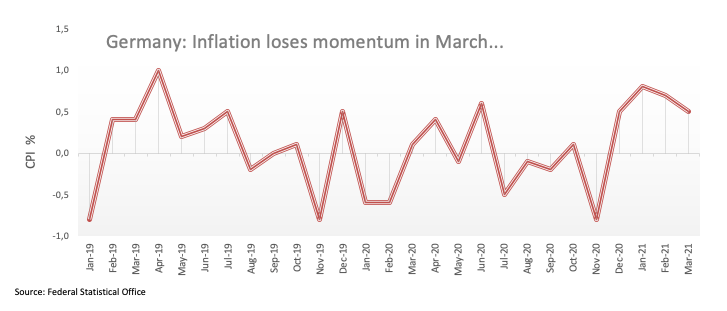

- German flash CPI rose 0.5% MoM and 1.7% YoY.

Further selling pressure hurts the single currency and drags EUR/USD closer to the 1.1700 neighbourhood in the wake of the NA opening on Tuesday.

EUR/USD weaker on USD-buying

EUR/USD drops further and threatens to challenge the key support at 1.17 the figure amidst the unabated march north in the greenback. Indeed, when tracked by the US Dollar Index (DXY), the buck navigates in levels last seen in early November 2020 beyond the 93.00 hurdle.

Spot receded further pari passu with the advance in US yields to new 2021 highs, all morphing into extra legs for the dollar’s rally at the same time.

In the euro data space, German preliminary inflation figures noted the CPI is expected to rise 0.5% MoM in March and 1.7% from a year earlier. Additional data saw the final Consumer Confidence gauge in the broader euro region at -10.8 for the current month.

Across the pond, the Conference Board’s Consumer Confidence will take centre stage later in the NA session.

What to look for around EUR

EUR/USD remains under heavy pressure and recedes to new lows further south of the 1.1800 mark. The strong pullback in the pair came along the persistent bid bias of the greenback, which has been undermining the constructive view in the pair in the past weeks. The deterioration of the morale in Euroland coupled with the poor pace of the vaccine rollout in the region and the outperformance of the US economy (vs. its G10 peers) have all been collaborating with the renewed offered stance around the single currency. However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair in the longer run.

Key events in the euro area this week: German labour market report, EMU’s flash CPI (Wednesday) – German Retail Sales, final PMIs in the euro area (Thursday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is losing 0.42% at 1.1715 and faces the next support at 1.1711 (2021 low Mar.30) seconded by 1.1574 (2008-2021 support line) and finally 1.1602 (monthly low Nov.4). On the upside, a breakout of 1.1862 (200-day SMA) would target 1.1989 (weekly high Mar.11) en route to 1.2000 (psychological level).