- EUR/USD’s upside loses momentum and approaches 1.2200.

- The dollar looks bid on the back of higher US yields.

- EMU final April CPI, FOMC Minutes next of note in the docket.

Following new highs near 1.2250 during early trade, EUR/USD now faces some selling pressure and recedes to the vicinity of the 1.2200 support.

EUR/USD now faces resistance around 1.2250

The upside in EUR/USD met a tough barrier in the mid-1.2200s so far, triggering the current pullback to the 1.2215/10 band, all amidst the pick-up in the dollar and increasing yields.

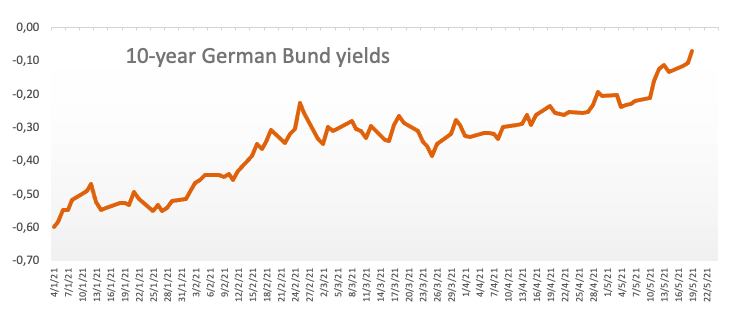

The corrective downside in the pair comes despite yields of the key German 10-year Bunds reclaim the -0.07% area, levels last seen in May 2019. In the same line, yields of the US 10-year reference manage to extend the bounce to the 1.67% so far on Wednesday.

In the docket, final April CPI figures for the broader Euroland are due later in the session, while the FOMC Minutes will take centre stage later in the NA trading hours.

What to look for around EUR

EUR/USD finally breaks above the key 1.2200 hurdle amidst the continuation of the recovery from last week’s lows in the mid-1.2000s, always on the back of the strong bounce in yields of the German 10-year Bund and the generalized upbeat tone in the risk complex. The sustained rebound in the pair also comes in response to the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace and solid results from key fundamentals pari passu with the surging morale in the bloc.

Key events in the euro area this week: Final EMU April CPI (Wednesday) – German/EMU flash May PMIs, advanced Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

EUR/USD levels to watch

So far, spot is losing 0.08% at 1.2212 and a break below 1.2051 (weekly low May 13) would target 1.1985 (monthly low May 5) en route to 1.1957 (200-day SMA). On the upside, the next resistance comes in at 1.2245 (monthly high May 19) followed by 1.2300 (round level) and finally 1.2349 (2021 high Jan.6).