- EUR/USD is under pressure as Europe’s coronavirus situation is deteriorating rapidly.

- Uncertainty about the US elections is boosting the safe-haven dollar.

- Wednesday’s four-hour chart is painting a bearish picture, with another support line at risk.

Lockdown 2.0? Europe’s largest countries are set to announce new measures as COVID-19 cases, hospitalizations, and deaths are rising quickly, and the euro is suffering.

French President Emmanuel Macron is scheduled to address the nation at 19:00 and possibly announce a month-long lockdown. Most citizens in Europe’s second-largest economy are under a nighttime curfew and other restrictions for several weeks – yet that has failed to stem the disease.

German Chancellor Angela Merkel is also mulling new measures, potentially leaving schools open but shuttering other activities. The “locomotive” of the eurozone has already been slowing down, and another setback is due.

The success of new measures heavily depends on public collaboration, and that is in shorter supply. Protests have erupted in Italy amid limitations to public life and dim economic prospects. The government responded by approving an aid package, but compliance with social distancing is likely to be weaker in the third-largest economy and elsewhere. Spain already declared a state of emergency and its regions are bracing for further curbs to activity.

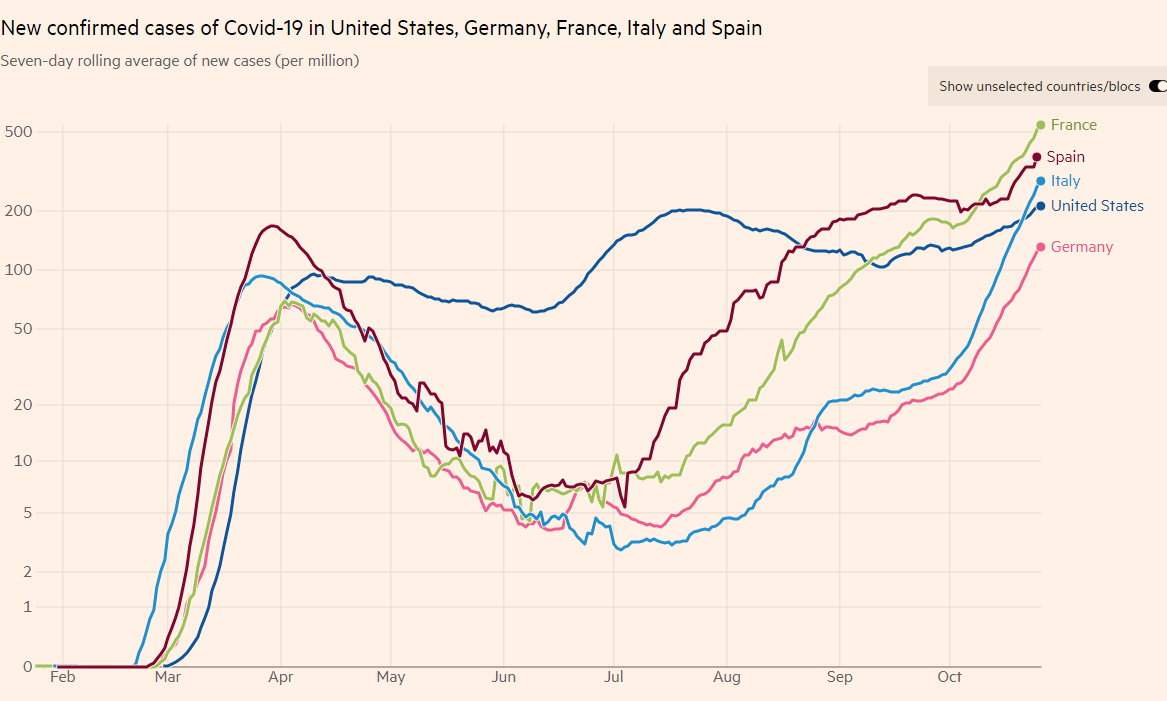

Coronavirus in the eurozone’s largest economies and the US:

Source: FT

The upcoming announcements by governments come ahead of Thursday’s rate decision by the European Central Bank. Economists expect the Frankfurt-based institution to leave its policy unchanged, but President Christine Lagarde and her colleagues could expand and extend the bond-buying scheme – or hint at such a move in September. The ECB may also publish its long-awaited strategic review, which may include a dovish tilt.

See ECB Preview: Three charts show why Lagarde could send EUR/USD tumbling

Six days are left until the US elections and over 70 million Americans have already cast their ballots – more than half the 2016 total vote count. Recent opinion polls have continued showing President Donald Trump trailing behind challenger Joe Biden, yet the surprise from four years ago is on investors’ minds.

Tighter polls in Florida and North Carolina, published on Tuesday, provide a reminder that the race is decided in several battleground states rather than at the national level. Trump lost the popular vote by nearly 3 million in 2016 but squeezed a victory by winning several key states.

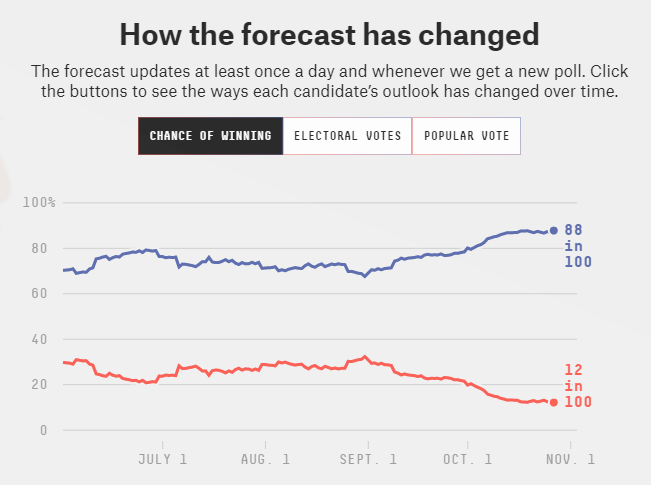

Nevertheless, FiveThirtyEight’s model continues pointing to an 88% chance for a Biden victory:

Source: FiveThirtyEight

The Economist’s model is showing Trump as having only a 5% chance of winning. The battle for the Senate is closer, with Dems’ probability at around 73%. Control of the upper chamber is critical for passing a generous stimulus package that markets crave for.

More 2020 US Election: Polling, history and the submerged Trump vote

Overall, covid fears and election uncertainty may add to pressures.

EUR/USD Technical Analysis

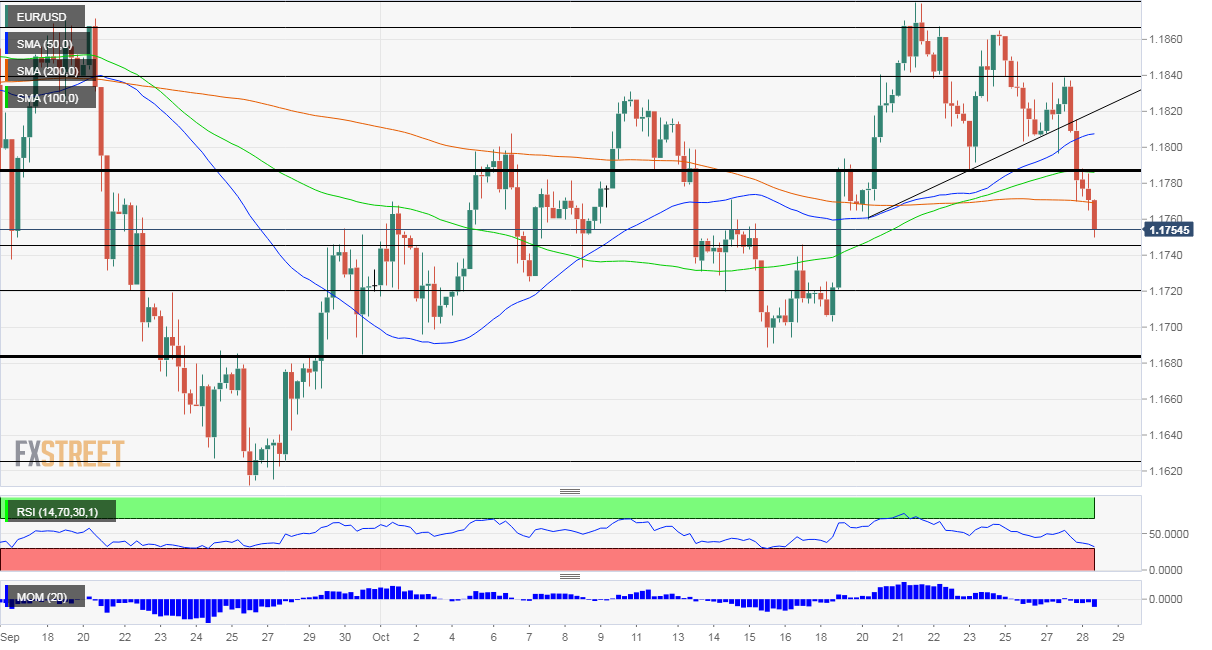

Euro/dollar dropped below the 50, 100, and 200 Simple Moving Averages on the four-hour chart and suffers from downside momentum. The Relative Strength Index is still above 30, thus outside oversold conditions.

Bears are in control.

Support awaits at 1.1745, which was a swing high in mid-October. It is followed by 1.1720, which was a wing low beforehand. The critical cushion is 1.1685, which is a double-bottom, last seen ten days ago. Further down, 1.1625 awaits.

Resistance is at 1.1785, which provided support last week. It is followed by this week’s stubborn cap of 1.1840, and then by 1.1880.