- EUR/USD gathers steam ad reaches session tops in the 1.1780/85 band.

- German Economic Sentiment improved to 71.5 for the current month.

- US NFIB Index, Producer Prices coming up next in the calendar.

The shared currency has regained the smile and is now lifting EUR/USD to the area of daily highs around 1.1780. on Tuesday.

EUR/USD bid on data, risk appetite

EUR/USD is reversing two consecutive daily pullbacks as the recovery in the greenback appears to be losing some traction in past hours.

The pair’s rebound from lows in the vicinity of 1.1720 has been bolstered by hopes of a deal in the US political scenario, where both Republicans and Democrats have committed to resume discussions around an extra stimulus package.

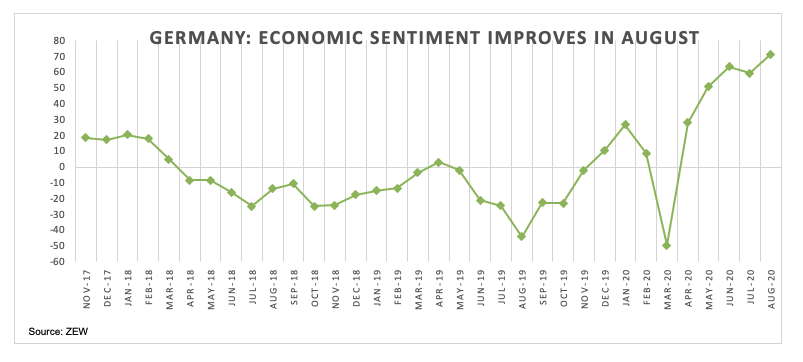

Extra oxygen to the European currency came in after the German ZEW survey showed the Economic Sentiment improved above estimates to 71.4 for the month of August. Additionally, the Economic Sentiment in the broader euro region also ticked higher to 64.0 during the same period.

In the wake of the release, ZEW officials still see a general recovery and noted that its pace remains firm.

Later in the NA session, the NFIB index is due followed by July’s Producer Prices.

What to look for around EUR

EUR/USD pushed higher and recorded new highs near 1.1920 in the second half of last week, triggering a corrective move to lows near 1.1720 so far. The July-August rally, while largely triggered by broad-based dollar-selling and improved sentiment in the risk-associated universe, found extra sustain in auspicious results from domestic fundamentals, which have been in turn supporting further the view of a strong economic recovery in the wake of the coronavirus fallout. Also lending wings to the momentum around the euro appear the recently clinched deal on the European Recovery Fund – which helped putting political fears within the bloc to rest (for now) – and the solid position of the current account in the region.

EUR/USD levels to watch

At the moment, the pair is advancing 0.37% at 1.1780 and a breakout of 1.1916 (2020 high Aug.6) would target 1.1996 (high May 14 2018) en route to 1.2032 (23.6% Fibo of the 2017-2018 rally). On the other hand, immediate contention is located at 1.1695 (weekly low Aug.3) followed by 1.1495 (monthly high Mar.9) and finally 1.1448 (50% Fibo of the 2017-2018 rally).