- EUR/USD keeps the trade near the 1.1200 handle.

- German Economic Sentiment plummets in August.

- US CPI results next of relevance later in the day.

The selling bias around the European currency stays well and sound on Tuesday, taking EUR/USD to the 1.1190/80 band.

EUR/USD unfazed by German, EMU data

The pair so far manages well to keep business in the vicinity of 1.1200 the figure, always sustained by (near term) repatriation flows and amidst absence of extra headlines on the US-China trade war.

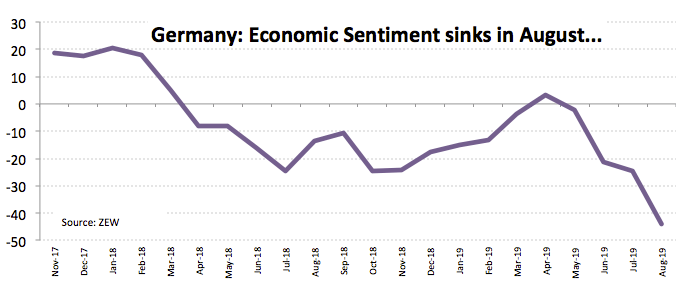

EUR keeps the composure so far despite the German Economic Sentiment sunk to -44.1 for the current month, the weakest print since December 2011. Today’s results signal further deterioration in the German economy and also point to a poor performance during Q3, opening the door at the same time for a potential technical recession in the country if advanced Q2 GDP results – due tomorrow – forecast a contraction of the economic activity in the April-June period.

Additional data saw German Current Conditions at -13.5 and Economic Sentiment in the broader euro area at -43.6.

What to look for around EUR

The reluctance of EUR to edge lower in the current risk-off environment could be reflected in ‘repatriation’ forces currently at play as well as the potential funding stance of the currency. Italian politics has resurfaced as a source of uncertainty as of late and is expected to weigh on the sentiment sooner rather than later. Sustained bullish attempts in the pair still look flimsy amidst ECB’s preparations for a fresh wave of monetary stimulus (most likely to be announced in September), including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system. In the meantime, the unremitting deterioration of the economic outlook in the region and the lack of traction in inflation are seen capping extra gains and are also lending extra support to the dovish stance of the ECB.

EUR/USD levels to watch

At the moment, the pair is retreating 0.15% at 1.1196 and faces the next down barrier at 1.1161 (low Aug.12) seconded by 1.1101 (monthly low Jul.25) and finally 1.1026 (2019 low Aug.1). On the flip side, a breakout of 1.1232 (55-day SMA) would target 1.1282 (high Jul.19) en route to 1.1292 (200-day SMA).