- EUR/USD has been edging lower as Chinese-inspired market enthusiasm wanes.

- Concerns about US coronavirus cases may return to the forefront after the “weekend effect”

- Eurozone data has been failing to impress in recent days.

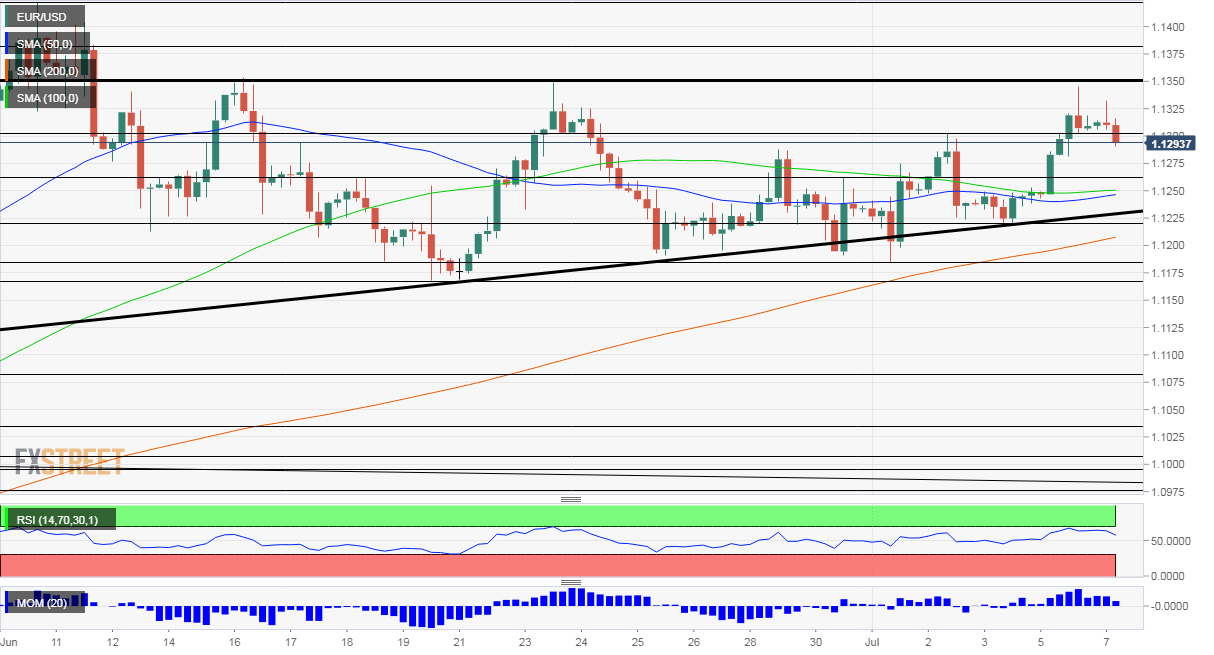

- Tuesday’s four-hour chart is pointing to a triple top.

Correction after hitting a near two-week high? EUR/USD’s upward path may be in jeopardy, at least for now. Europe’s control of coronavirus is promising and hopes for massive EU stimulus are also supportive, but the currency pair has three reasons to extend its downward correction.

1) Curbing Chinese enthusiasm

Monday’s primary market drive came from China – where state media touted a bullish stock market to follow up the recovery. Stocks surges in Shanghai and searches for “open stock account” skyrocketed in Chinese search engines. Optimism carried away shares in other areas and the safe-haven dollar came under pressure.

Trading volumes hit the highest since 2015 – but that year’s rally eventually ended in a burst bubble. Perhaps aware of the dangers of pumping up valuations, all four of China’s major state-owned financial outlets called for investors and speculators to be rational – weighing on stocks. That is allowing the dollar to recover.

2) Weaker eurozone figures

Germany’s economy is rebounding – but less than expected. Industrial output rose by 7.8% in May, weaker than expected. Tuesday’s publication follows Monday’s disappointing Factory Orders figure which advanced by only 10.4%. While these increases are massive in absolute terms, they follow plunges in April and March.

The Sentix Investor Confidence also recovered to -18.2 points, but that still reflects deep pessimism. France’s trade balance deficit grew more than expected

Overall, the road to recovery is slow, despite Europe’s controlled opening up.

3) US coronavirus cases – the weekend is over

US investors clung onto encouraging US COVID-19 statistics, showing fewer than 50,000 new cases and a drop in deaths below 300, as per the Center for Disease Control. However, it is essential to note that reports coming out on Monday suffer from the “weekend effect” – underreporting over the weekend.

The past weekend has been longer – due to Independence Day – and administrative work may be catching up on Tuesday. Reports from Florida, California, and Texas – where some hospitals are overwhelmed – may dampen the mood and boost the greenback.

EUR/USD has been on the back foot and has room to extend its decline.

Other US developments

The US calendar features the JOLTs job openings report for May- a labor market update that is eyed by the Federal Reserve and has some importance despite its late release. The Non-Farm Payrolls already released on Thursday relate to June.

The ISM Non-Manufacturing Purchasing Managers’ Index smashed expectations with 57.1 points – yet it probably fails to effect the recent decline in economic activity due to the spread of the virus. Raphael Bostic, President of the Atlanta branch of the Federal Reserve, said the recovery probably leveled off.

The virus and the economy have political implications.

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100, and 200 Simple Moving Averages and momentum remains positive – but its third failure to break above 1.1350 is a bearish sign. What cannot go up must come down, at least for now.

Support awaits at 1.1265, a swing high from last week, followed by 1.1220, a support line from back then. The next lines to watch are 1.1185 and 1.1185.

Initial resistance is at the swing high of 1.13, followed by the triple-top of 1.1350 mentioned earlier. Further above, 1.1385 and 1.1410 await EUR/USD.