EUR/USD has been retreating from the highs as hawkish comments from a member of the European Central Bank only lifted the currency pair temporarily. Euro-zone and US inflation figures are due out later today and the technical picture looks unfavorable.

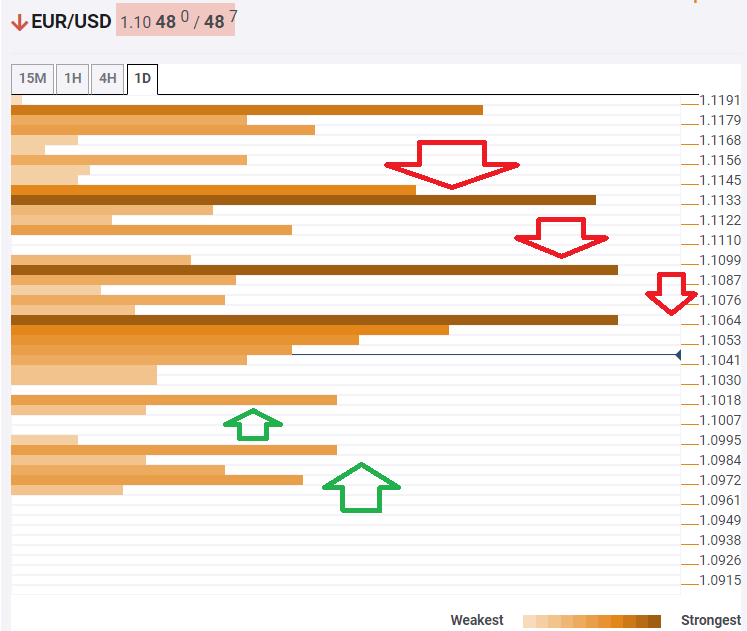

The Technical Confluences Indicator is showing that EUR/USD has weak support at 1.1018, which is the convergence of the Pivot Point one-day Support 2 and the PP one-week S2.

Further down, the next support line is also weak and already awaits euro/dollar below 1.1000. At 1.0984 we see the confluence of the PP 1d-S3 and the Fibonacci 161.8% one-week.

Looking up, EUR/USD faces fierce resistance at 1.1064, which is a dense cluster of lines including the Bollinger Band 1h-Middle, the previous monthly low, the Fibonacci 38.2% one-day, and the Simple Moving Average 100-15m.

The next cap is also considerable. At 1.1093 we see the SMA 10-1d, the Fibonacci 61.8% one-week, and the SMA 50-4h converge.

Another hurdle awaits at 1.1133, which is the meeting point of the Fibonacci 23.6% one-week, the BB 1d-Middle, and more.

Here is how it looks on the tool: