- Risk-free markets remain under pressure, as the EUR/USD holds the previous day’s pullback from the weekly high.

- As inflation worries recur ahead of the US jobs report, bullish sentiment towards the US dollar peaked.

- A slowing economy, the Russian-Ukrainian crisis and the ECB’s departure from the Fed give sellers hope.

The EUR/USD outlook is bearish as inflation concerns play a role before key US non-farm payrolls (NFP) figures are released en route to Friday’s European session.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

On the other hand, the major currency pair fell the most in a week the day before after the Bank of England’s (BOE) dovish economic outlook raised the US dollar’s value on its traditional safe-haven appeal. However, recent hawkish comments from Germany’s IFO head have challenged the bearish pair.

According to Reuters, Ifo CEO Clemens Fuest said a rise in the US interest rate leads to an appreciation of the US dollar against the Euro, which increases inflationary pressure in Europe. According to the news, “the ECB is under some pressure in this regard.”

In other news, a quarter-end monetary policy statement by the Reserve Bank of Australia raised inflation expectations sharply for 2022 and 2023, following the Bank of England’s double-digit inflation outlook. In addition, a measure of price pressure is also shown by Japan’s Consumer Price Index (CPI).

Market sentiment and the EUR/USD exchange rate are also affected by concerns related to economic conditions in China and the Russian-Ukrainian crisis.

The sentiment is reflected in S&P 500 futures, returning to yearly lows hit by at least 0.10% earlier this week, while 10-year yields have reached their highest level since late 2018, which ended on Thursday.

Traders will watch the Fedspeak block report, and second-tier data ahead of the US jobs report and intermediate-risk catalysts. For example, forecasts suggest that US non-farm payrolls (NFP) may fall from 431K to 391K and that the unemployment rate may drop from 3.6% to 3.5%.

The EUR/USD should continue to decline if the jobs report does not show an easing of the jobs crisis.

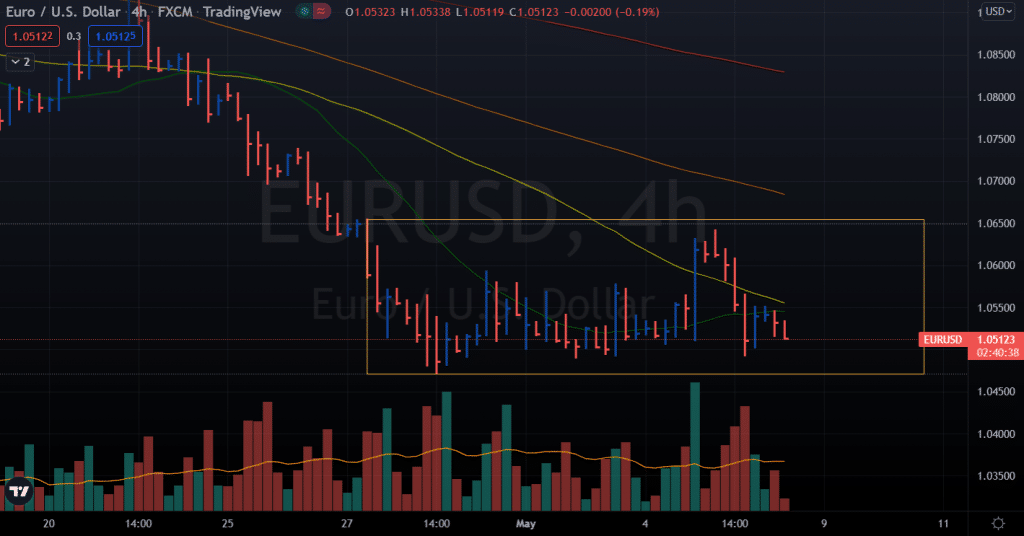

EUR/USD price technical outlook: Bears eying range breakout

The EUR/USD price found interim support just below the 1.0500 mark. The pair is playing within the range. Hence, the traders should watch the range breakout to find decent trading opportunities.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

The volume data lies in favor of the bears. Hence, the pair may slip towards the 1.0400 level ahead of 10260 and finally hit the parity level around 1.000.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money