- EUR/USD finds relief amid positive risk flows.

- Hawkish FOMC and mixed ECB comments continue to weigh on the pair.

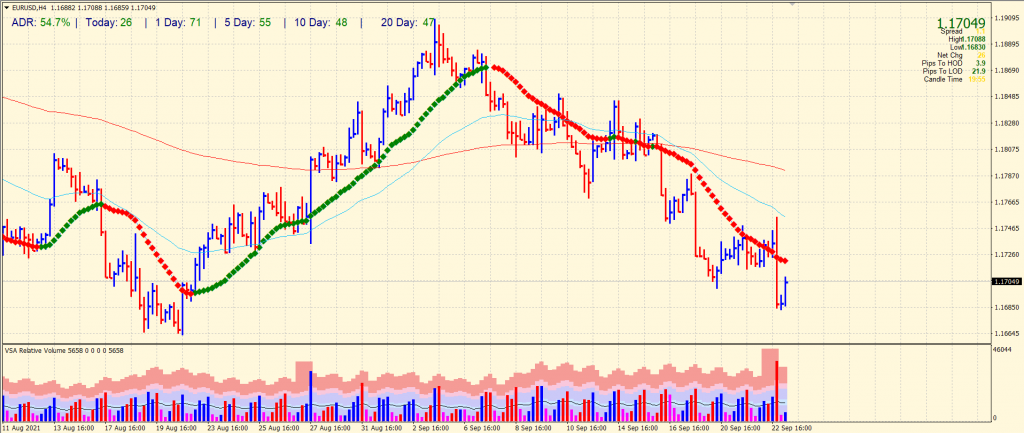

- The relief rally may be capped by 50-SMA around 1.1750.

The EUR/USD outlook is bearish after the hawkish FOMC. However, the price is attempting to rise above the 1.1700 level amid positive risk flows.

The EUR/USD is at 1.1705, up 0.16%, at the time of writing.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Fundamental outlook: FOMC and risk sentiment to weigh

After the Federal Reserve System (FRS) announced signs of a long-awaited tapering in bond purchases, the major currency pair fell to its lowest level since August 20 the previous day. However, the US dollar pulled back as risk appetite improved, causing the EUR/USD pair to rebound from a multi-day low.

Even as major rating agencies express their concerns about China’s burdens under Evergrande, the real estate company is confident about the future. Beijing’s money market is also protected by the People’s Bank of China (PBOC). Additionally, the FDA’s approval of Pfizer BioNTech’s booster vaccine for over 65s and US policies being implemented that have passed the long-awaited incentive have improved risk sentiment and indirectly affected the US dollar.

The US dollar has rallied after the Federal Reserve announced that it would reduce asset purchases. Jerome Powell, chairman of the Fed, says “it is time to start tapering” and indicates that it will happen at the next meeting if the economy goes as expected. But the most important thing is that the tapering may end by mid-2022.

Due to the safe-haven nature of the US dollar, only stocks prevented an overall rise in the US dollar. As a result, concerns over Evergrande’s massive debt were eased when the company announced it could pay interest on land-based bonds. Additionally, it has been rumored that the Chinese government will divide the company into three distinct companies. However, the information has not been confirmed, so it remains uncertain.

Moreover, the mixed comments made by Madis Müller mocked the previously restrictive comments from ECB policymakers and pressured the EUR/USD prices.

EUR/USD price technical outlook: 50-SMA keeping bulls pressured

The EUR/USD price plunged to multi-day lows at 1.1685, where the pair found some traction and is back above the 1.1700 mark. However, the price is well below the key support of 20-period and 50-period SMAs on the 4-hour chart at 1.1725 and 1.1750, respectively. The volume for the fall was too high, and the pair might only be absorbing the change before continuing to grind lower.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

On the downside, the EUR/USD price may see a swing towards the YTD lows at 1.1660 ahead of round-number support at 1.1600. Furthermore, the pair has completed 54% averaged daily range in the Asian session, which indicates a potential of big moves on the day.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.