- EUR/USD consolidates gains above 1.1800.

- US President Joe Biden delivered a strategic six-part speech that kicked off the Asia session.

- The European Central Bank (ECB) was prepared to adjust all instruments to ensure inflation stabilizes at 2% in the medium term.

The EUR/USD price outlook is bullish as the price remains above the key levels. Following the previous day’s recovery move above 1.1800, the EUR/USD pair has recently rallied around an intraday high of 1.1833 ahead of Friday’s European session. Due to the recent positive risk appetite, this major currency pair is in reaction to the weakness of the US dollar.

-Are you looking for automated trading? Check our detailed guide-

On Friday, US President Joe Biden delivered a strategic six-part speech that kicked off the Asia session. Mood recently improved when Biden and Xi Jinping met for the first time in seven months.

The Chinese media reported, “Xi and Biden openly discussed the US-China relationship.” However, the negotiations seem less optimistic on the US side and are described as “broader strategic discussions.”

Biden’s drive for vaccines and masks contributes to the positive sentiment in the vaccine market alongside the UK’s endorsement of booster doses of Covid vaccines.

Tapering is part of the Fed’s revitalization efforts and concerns about the Coronavirus. The willingness of Australia to annoy China by ending the port agreement is also challenging the dollar bears.

While the US Dollar Index (DXY), 92.48 at the time of publication, is down 0.04% for the second consecutive year, the yield on the 10-year US Treasury is 1.1 basis points (bps) after rising by 1.31%. At the latest, the US and European stock futures remain positive.

The European Central Bank (ECB) was prepared to adjust all instruments to ensure inflation stabilizes at 2% in the medium term. Today’s consumer price inflation estimate in Germany could help. Euro traders should be aware of this. Moreover, as the bullish pair seeks confirmation of cautious bullish statements from the previous day, the ECB President’s comments, published around 9:30 am GMT, will be important.

-If you are interested in forex day trading then have a read of our guide to getting started-

A significant factor to watch is the US’s producer price index (PPI) for August, which is 0.6% m/m instead of 1.0% as anticipated.

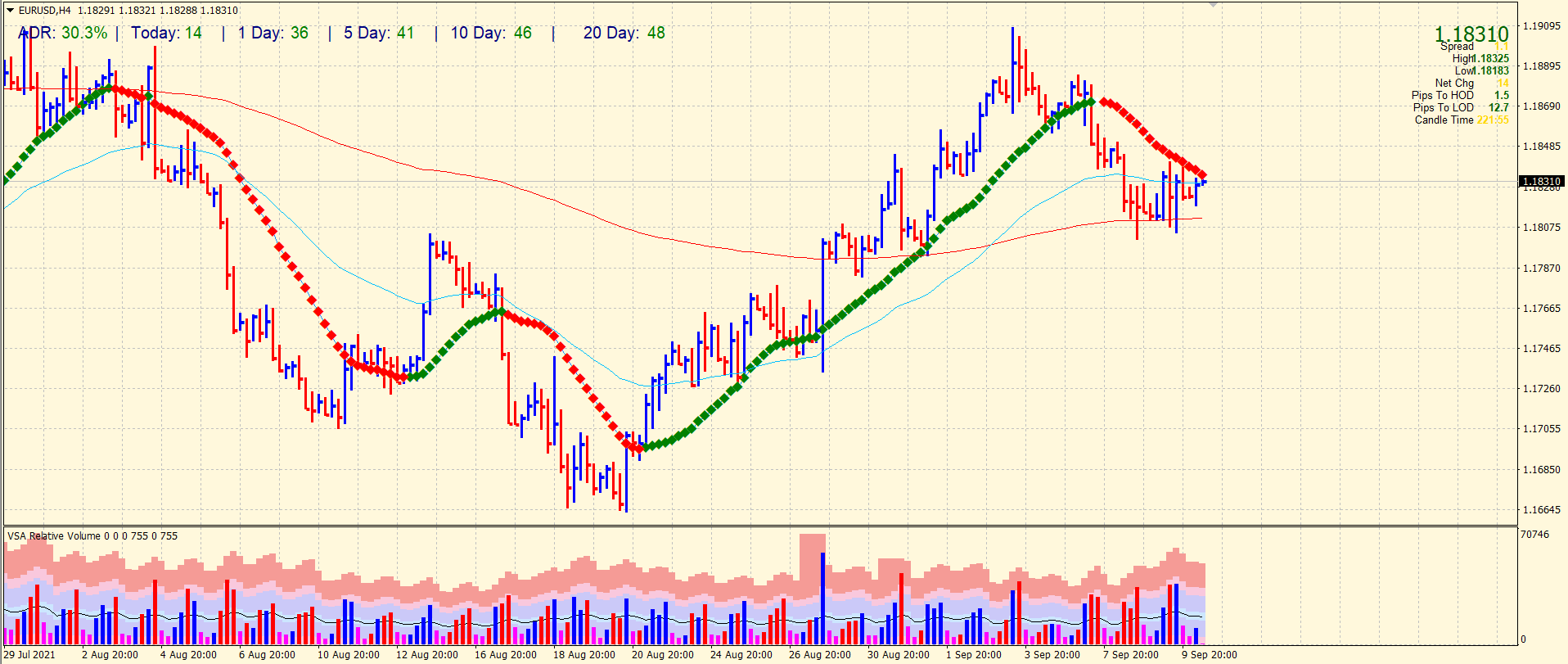

EUR/USD price technical outlook: 20/50 SMAs capping gains

The EUR/USD price remains strongly supported by the 200-period SMA on the 4-hour chart. However, gains are primarily capped by the confluence of 20 and 50 SMAs. On breaking the confluence, the price may reach the 1.1900 level ahead of the double top at 1.1910. On the downside, 1.1800 and 200-period SMA will provide support ahead of 1.1770.

The price is now consolidating after posting a shakeout bar with a very high volume. As a result, the price may likely pierce the resistance levels and test the 1.1900 area.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.